Altcoin Performance And Market Cycles

As of January 2, 2026, the crypto market is currently navigating a pivotal transition. The "Four-Year Cycle" is being challenged by a "Structural Era" driven by institutional money, shifting how altcoins perform relative to Bitcoin.

Go Back

🕒 9:02 PM

📅 Jan 02, 2026

✍️ By chyneyz

1. Current Market Status (January 2026)

The market has entered 2026 on a cautiously bullish note after a volatile end to 2025.

Altcoin Season Index: Currently sitting at 17/100, which indicates we are firmly in "Bitcoin Season."

BTC Dominance: High, at approximately 59.4%. Historically, an "Altcoin Season" only triggers when this dominance begins to trend downward.

Fear & Greed Index: Reading at 34 (Fear), up slightly from December. Investors are still cautious, but institutional "whale" accumulation is rising.

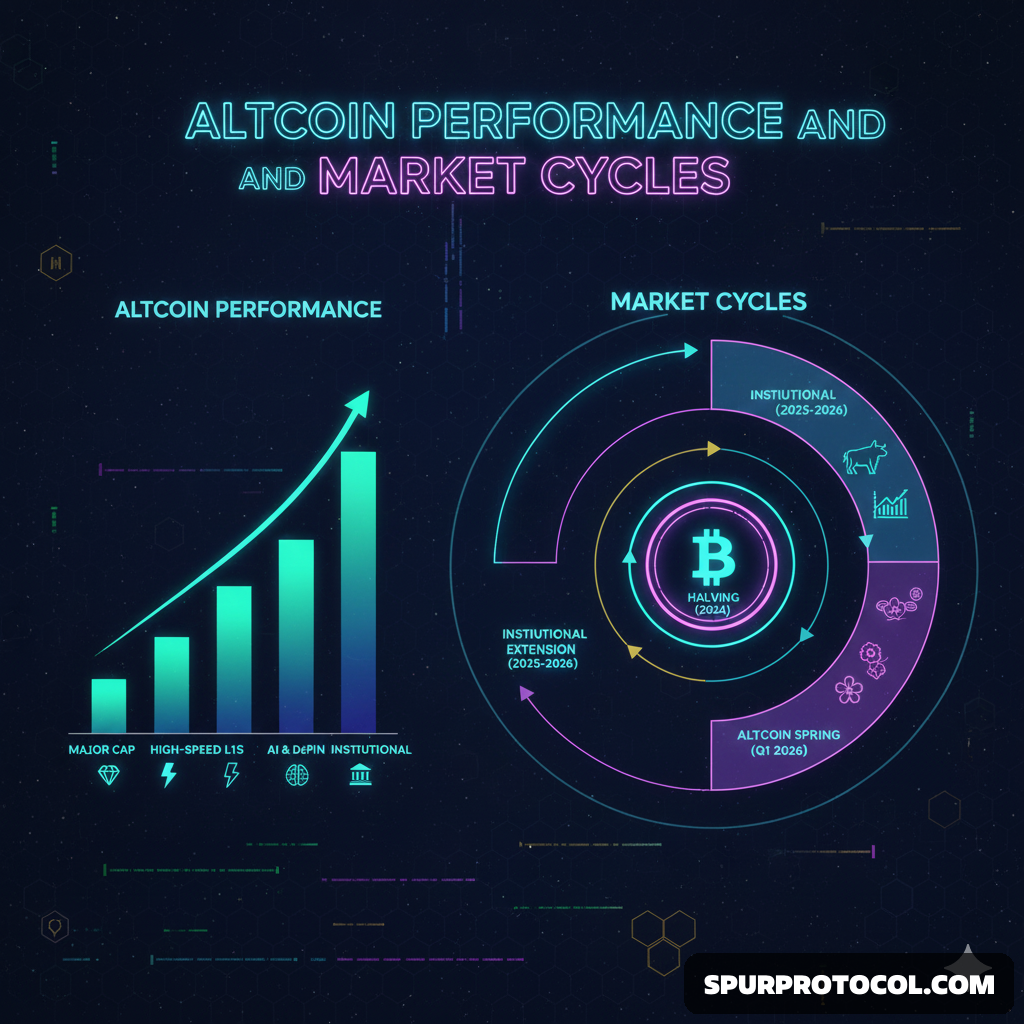

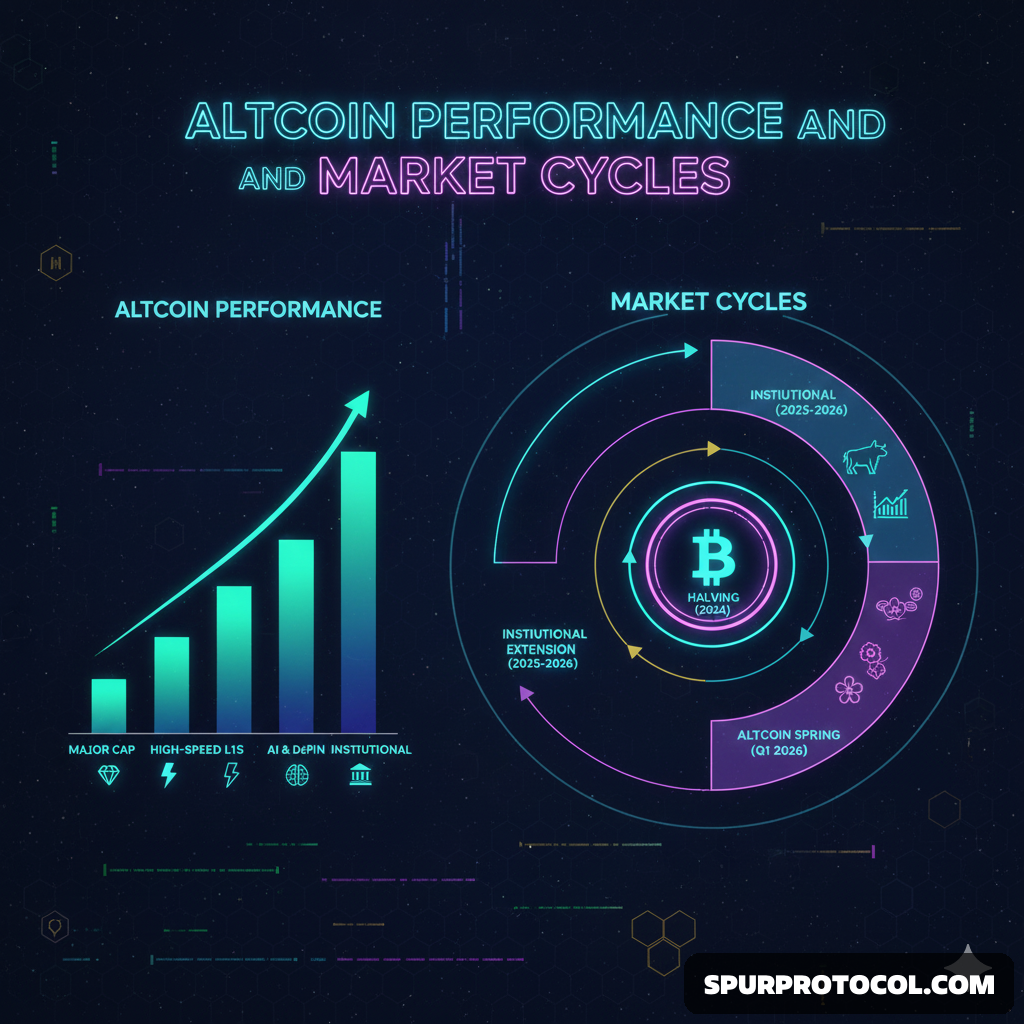

2. Altcoin Performance Tiers

In 2026, the performance of altcoins is highly fragmented. The days of "all boats rising with the tide" are largely over; capital is now rotating into specific narratives.

3. The 2026 Market Cycle Theory

There is a growing debate among analysts about whether the traditional four-year cycle (halving \rightarrow bull \rightarrow bear) has broken.

The "Institutional Extension"

Grayscale and other analysts suggest 2026 marks the "Dawn of the Institutional Era." Instead of a deep "crypto winter" (which traditionally would have occurred in 2026 following the 2024 halving), the market is seeing:

Reduced Volatility: Spot ETFs for BTC and ETH have created a floor, preventing the 80–90% crashes seen in previous cycles.

Selective Rallies: Capital no longer flows into "junk coins." It stays in projects with real-world revenue or heavy institutional backing.

Liquidity-Driven Moves: Altcoin performance is now more correlated with global liquidity (Federal Reserve rates) than just Bitcoin's price movements.

4. Key Watchlist for Q1 2026

The "January Reversal": Some technical analysts predict a "turning point" in late January where Bitcoin's dominance peaks, potentially triggering an Altcoin Spring in February/March.

Regulatory Milestones: The debate over the CLARITY Act and the GENIUS Act (stablecoin regulation) this month is expected to provide the legal certainty needed for a major altcoin breakout.

Risk Note: While specific tokens like Dogecoin (+8%) are showing strength, over 50% of retail investors recorded losses in 2025 due to chasing "narrative hype." Discipline in 2026 is focusing on liquidity and fundamental utility.