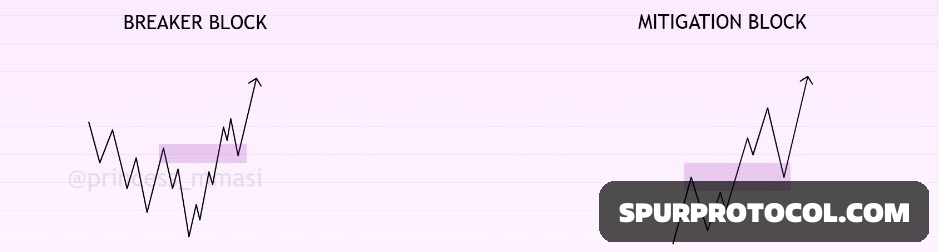

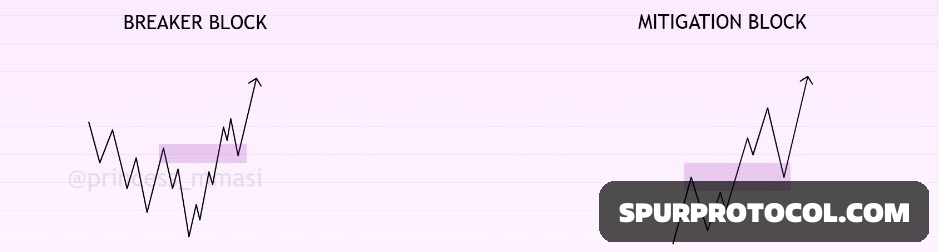

BREAKERS & MITIGATION BLOCKS

Think of a breaker/mitigation block like that one toxic ex you swore you were done with but somehow, you always go back to settle things🙃

POI Series (Breakers/mitigation blocks)

Go Back

🕒 4:36 PM

📅 Sep 21, 2025

✍️ By chrison2

Breaker blocks and mitigation blocks have one thing in common- They are both invalidated order blocks. Meaning they are failed order blocks that price may reverse to. Think of it as a resistance turn support or support turn resistance.

The key difference is: Breaker blocks are reversal entries, while mitigation blocks support continuations.

You get breaker block entries after a CHoCH and a mitigation block after a BOS.

Identifying high-probability breaker or mitigation blocks involves analyzing the range.

It should also include a Fair Value Gap (FVG) and an inducement. It attracts price, induces early buyers/sellers and the market often retraces to fill these gaps and mitigate the Breaker/mitigation block before continuing its trend.

Now here is the trading tip:

In a trading range, breakers/mitigation blocks can be used as a POI beyond the equilibrium when price has indicated it’s ready for a reversal into the premium/discount zone.

If there is no reversal pattern and ur BB or MB entry is beyond the equilibrium, you may miss out on the next move.

On the other hand- when there is no reversal pattern or reaction from an opposite area of interest, you can use a BB or MB before the equilibrium