Crypto Dos And Don'ts For Safe Investing

A Strategic Guide to Dos and Don'ts in Crypto

Go Back

🕒 7:07 AM

📅 Mar 19, 2025

✍️ By Allprojects

A Strategic Guide to Dos and Don'ts in Crypto

Go Back

🕒 7:07 AM

📅 Mar 19, 2025

✍️ By Allprojects

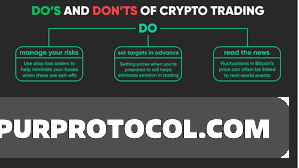

Dos:

Don'ts:

Final Tips: