Crypto Flash Loans - How People Make Millions Without Capital

Flash Loans - The Secret To Making Millions In Seconds

Go Back

🕒 5:42 AM

📅 Feb 28, 2025

✍️ By chybunz

Flash Loans - The Secret To Making Millions In Seconds

Go Back

🕒 5:42 AM

📅 Feb 28, 2025

✍️ By chybunz

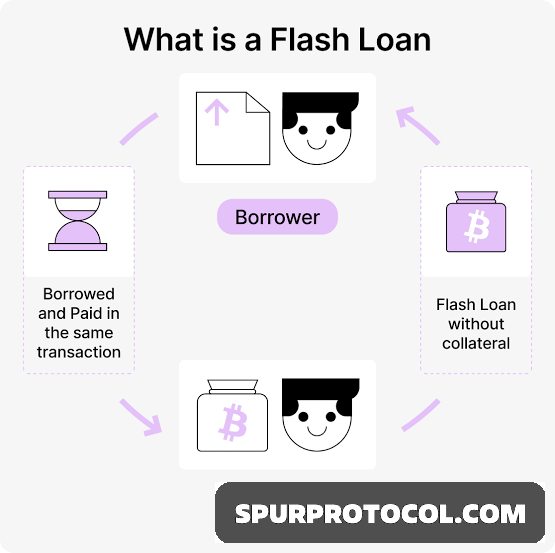

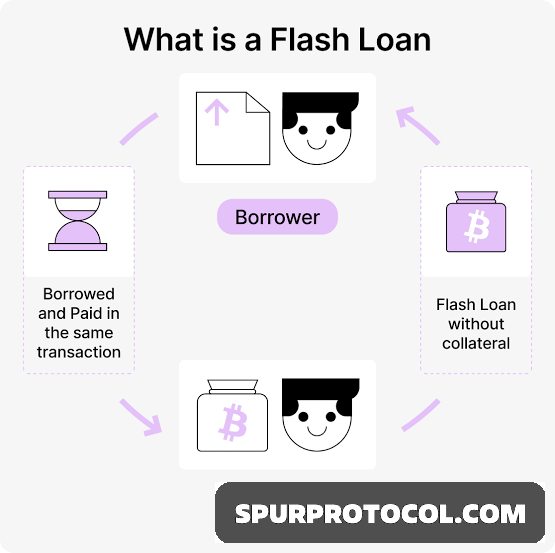

What Are Flash Loans?

Imagine borrowing a million dollars without needing collateral, using it for a profitable trade, and repaying it, all in seconds. Sounds impossible, right? Welcome to the world of flash loans.

A flash loan is a special type of instant loan in crypto that does not require collateral. The catch? You must repay it within the same transaction block otherwise, the loan is automatically reversed.

Flash loans are powerful tools for traders, but they can also be dangerous weapons in the hands of hackers.

How Do Flash Loans Work?

1. Borrow Crypto: You take a loan from a DeFi platform like Aave or dYdX.

2. Use the Funds for a Trade: This could be arbitrage, liquidation, or any profitable strategy.

3. Repay the Loan in the Same Transaction: If you fail, the entire process is canceled as if it never happened.

Real-Life Example: How Traders Make Millions with Flash Loans

Let’s say Bitcoin is $40,000 on Binance and $41,000 on Uniswap. That’s a $1,000 price difference between the two platforms. A trader can:

1. Borrow $1,000,000 in BTC using a flash loan.

2. Buy BTC at $40,000 per coin on Binance.

3. Instantly sell the BTC at $41,000 per coin on Uniswap.

4. Repay the flash loan and keep the $25,000 profit (after fees).

All of this happens in seconds, without using their own money!

The Risks: Flash Loan Attacks

Flash loans are not just for traders, they are also used in exploits and attacks.

Case Study: The Cream Finance Hack ($130M Stolen)

In 2021, a hacker used flash loans to manipulate the price of a token, borrow more than they should have, and drain the platform’s funds. Since then, multiple DeFi protocols have suffered similar attacks.

Final Thoughts

Flash loans are one of the most advanced tools in DeFi. They can make you rich, but they also come with risks. If you want to explore them, understand how they work first and always trade responsibly.