Do You Know LOSS AVERSION?

Spoon feeding is what is needed here.

Go Back

🕒 10:33 PM

📅 Sep 20, 2025

✍️ By chrison2

Studying this will make you a 10x better trader/investor.

🔹INTRO

The Prospect Theory, developed by Daniel Kahneman and Amos Tversky in 1979, is a key concept in behavioral economics.

It describes how people make decisions involving risk and uncertainty, particularly when they are faced with the potential for gains or losses.

Unlike traditional economic theory, which assumes people behave rationally to maximize their utility...LOL

Prospect Theory recognizes that people often act irrationally, influenced by psychological biases.

There's quite a few elements that need to be considered.

But I don't want to overload your brain.

Let's just look at one of the most significant findings of Prospect Theory.

🔹LOSS AVERSION

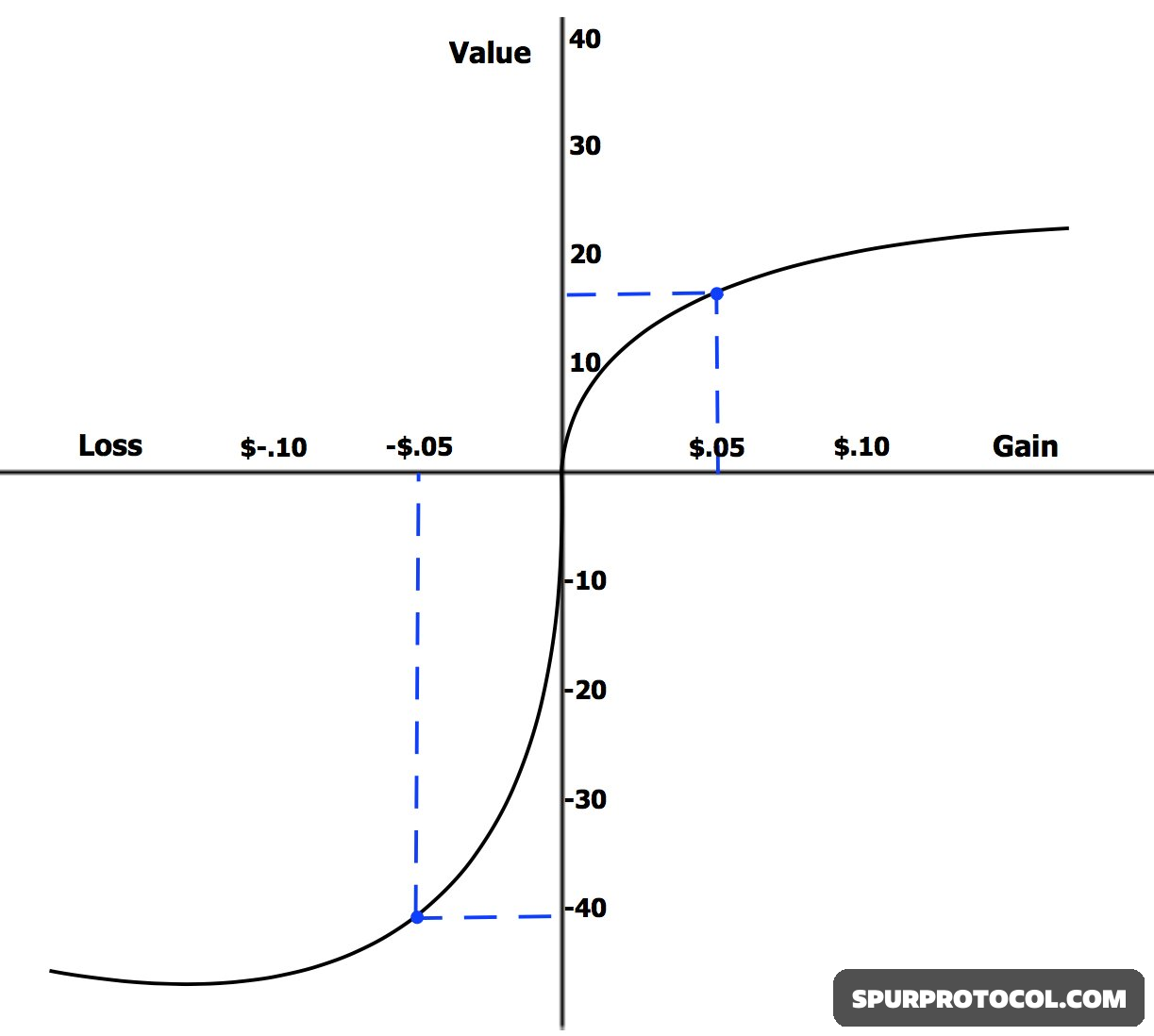

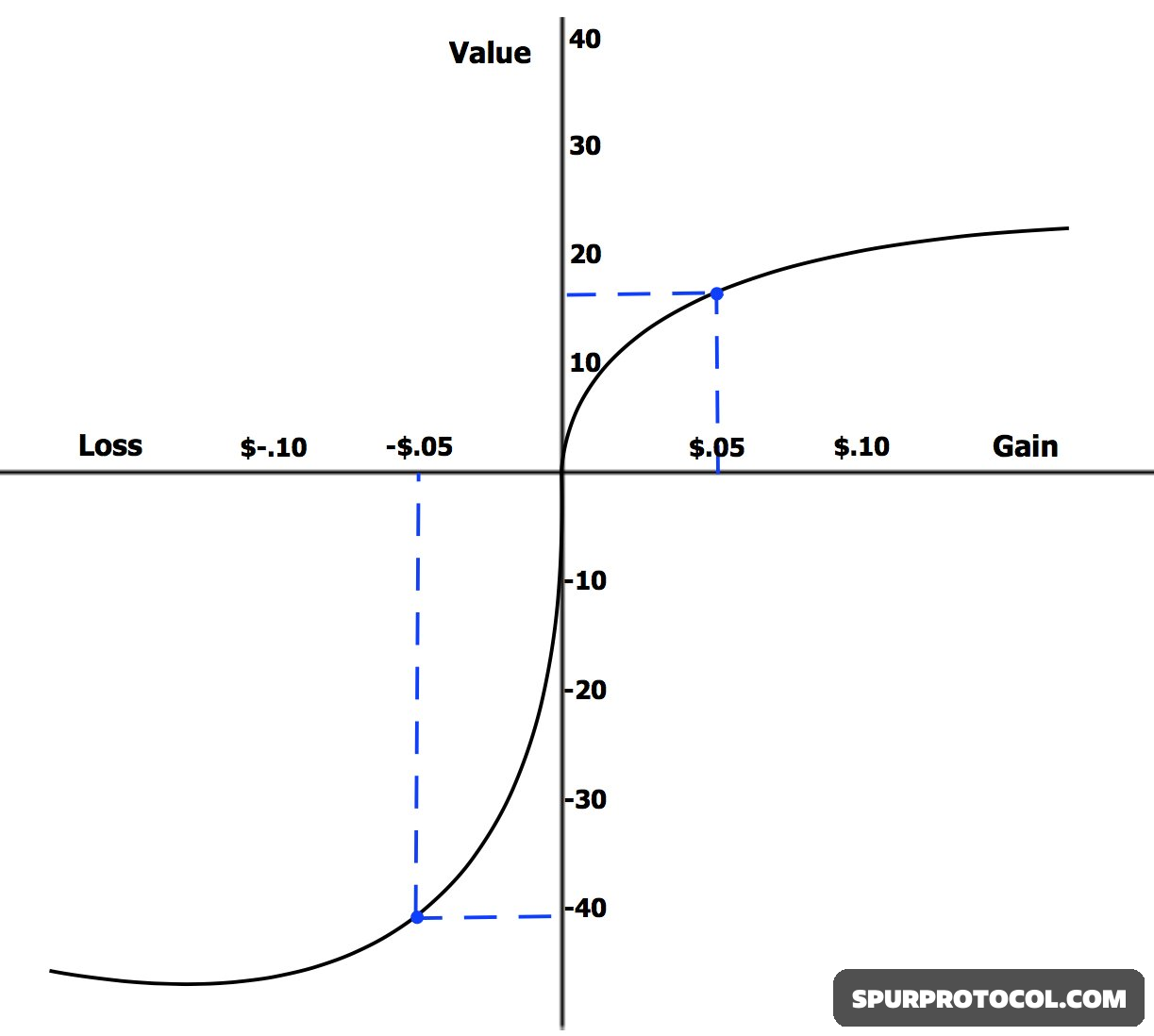

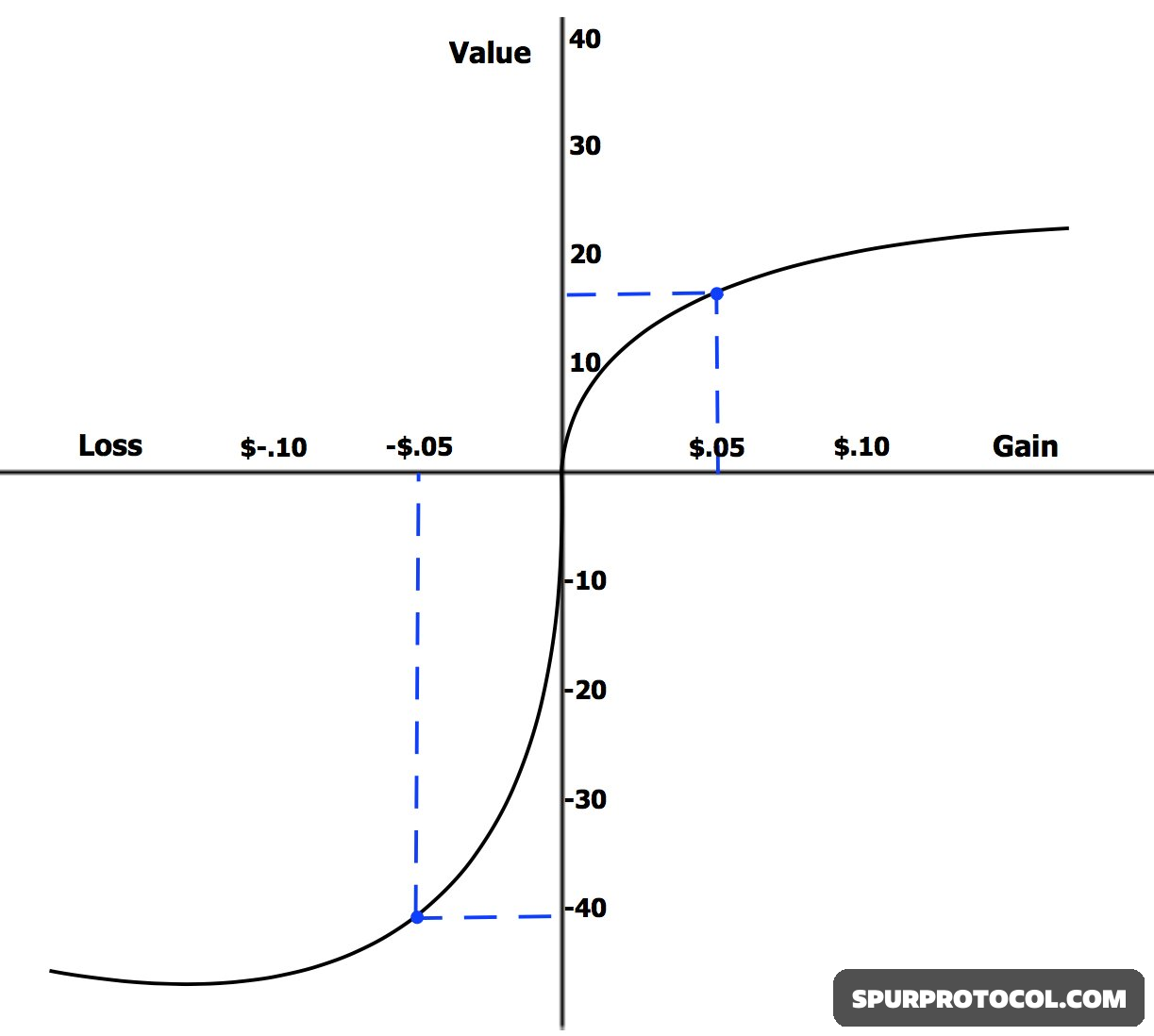

The concept, known as loss aversion, suggests that people are more motivated to avoid losses than to acquire equivalent gains.

The loss aversion coefficient, typically estimated to be around 2:1, means losses feel about twice as bad as gains feel good.

Or in simple words.

Your brain reacts heavier to losses than it does to gains.

While a $100 gain will be very nice to most in here.

A $100 loss will at the same time be absolutely devastating.

Why am I telling you this?

Because its one of the reasons you keep failing.

Your decisions might be influenced by an irrational fear of losing.

I don't want to go too far into this yet and let you read into it.

But tell me first, how is your brain wired?

Do you feel the pain more than the gain?