How Does DeFi Differ From Traditional Finance?

Differences between DeFi and traditional Finance.

Go Back

🕒 7:21 PM

📅 May 16, 2025

✍️ By oluwafemighty

Differences between DeFi and traditional Finance.

Go Back

🕒 7:21 PM

📅 May 16, 2025

✍️ By oluwafemighty

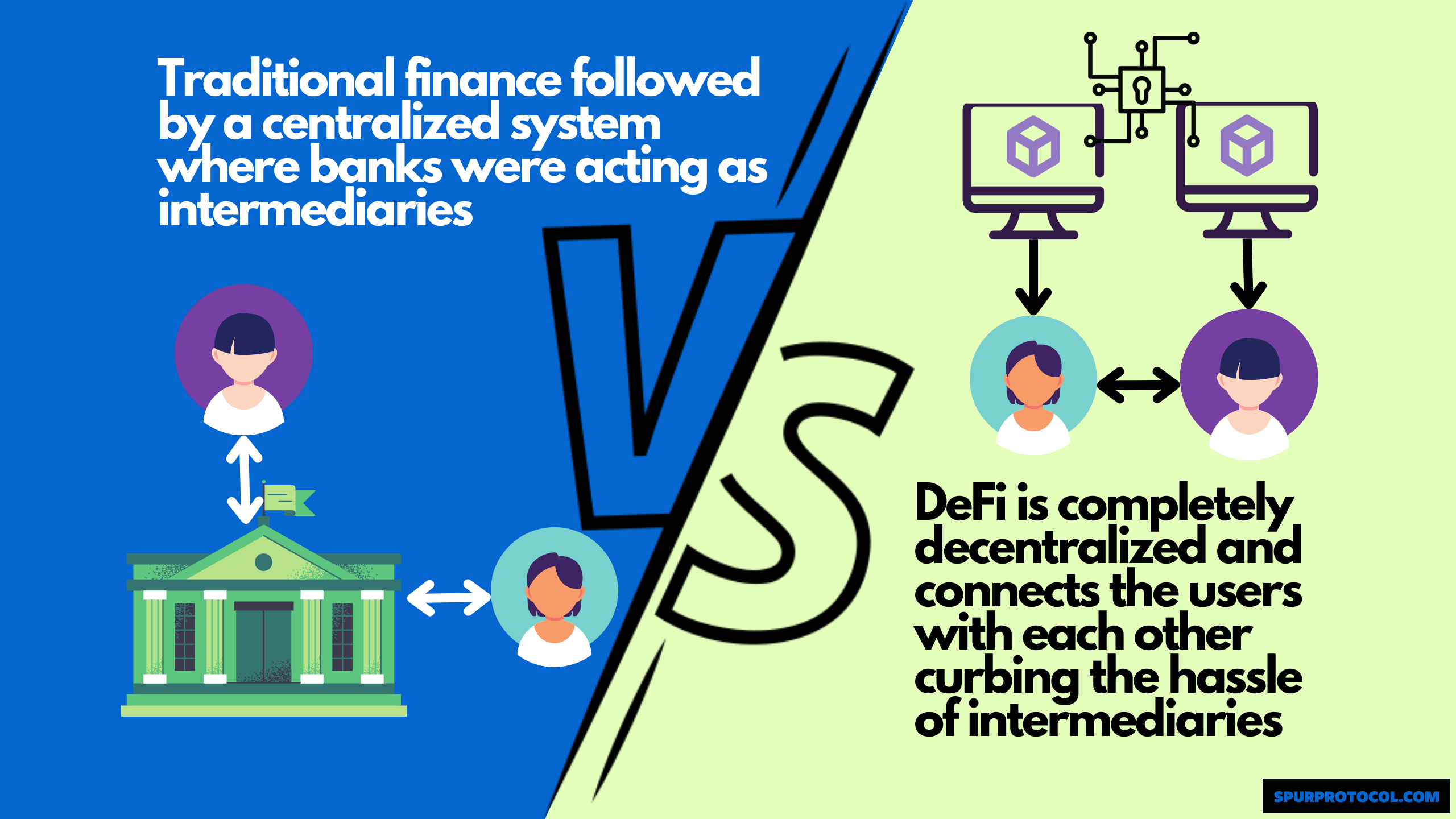

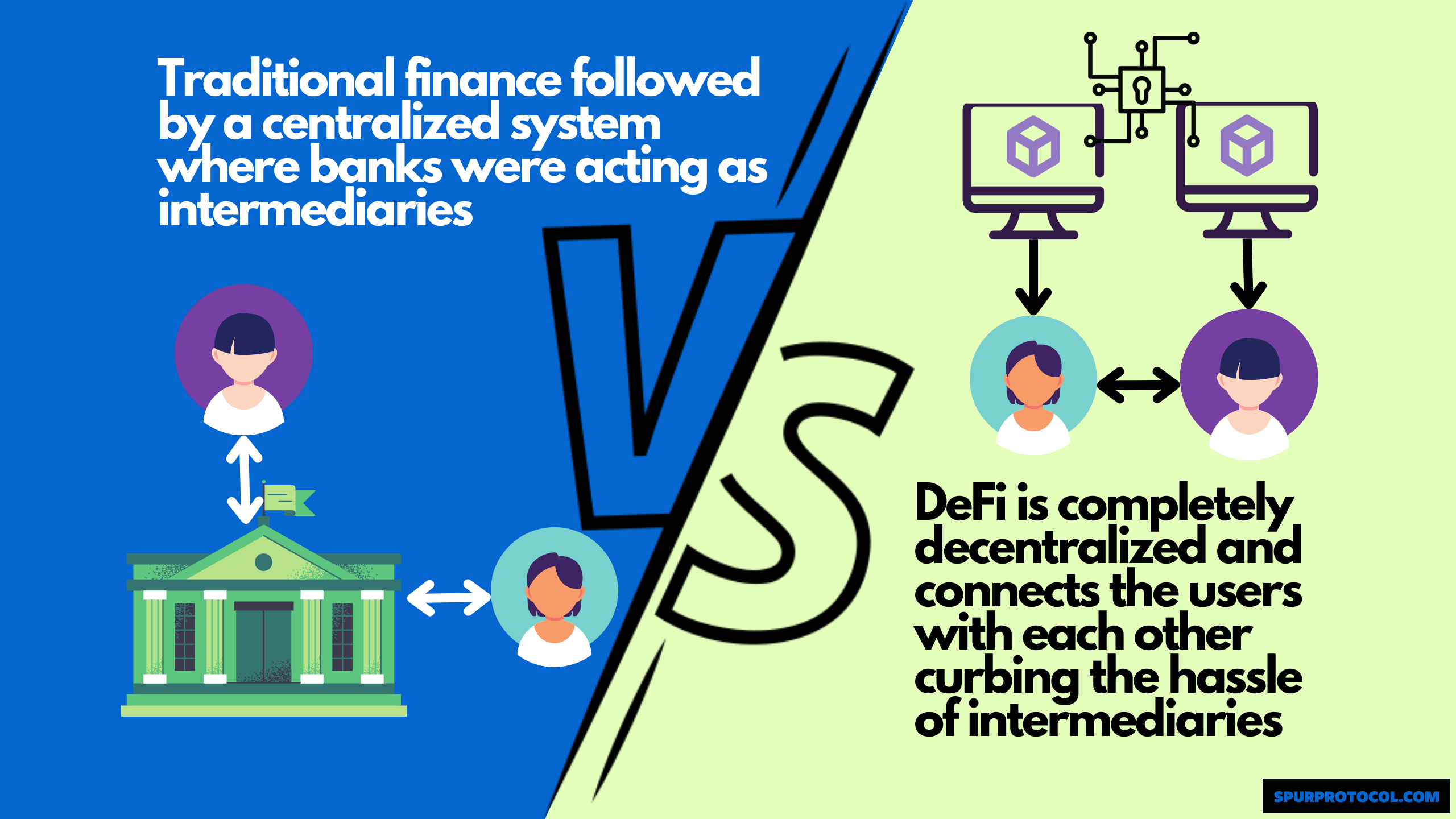

Decentralized Finance (DeFi) differs from traditional finance in several key ways which are:

1. Intermediaries

Traditional Finance: Relies on centralized institutions like banks, brokers, and payment processors.

DeFi: Operates on blockchain networks without intermediaries. Smart contracts automate transactions and services.

2. Accessibility

Traditional Finance: Often requires identification, credit checks, and is limited by regional regulations.

DeFi: Open to anyone with an internet connection and a crypto wallet, with no gatekeepers.

3. Transparency

Traditional Finance: Operates largely behind closed doors. Users must trust institutions.

DeFi: Code and transaction data are public on the blockchain, enabling full transparency and auditability.

4. Control and Custody

Traditional Finance: Financial institutions hold and manage user funds.

DeFi: Users retain custody of their assets and interact with protocols directly.

5. Innovation and Programmability

Traditional Finance: Slow to innovate due to regulation and infrastructure.

DeFi: Rapid innovation with programmable money, enabling features like automated lending, staking, and yield farming.

6. Costs and Speed

Traditional Finance: Involves higher fees and slower settlement times (especially for cross-border payments).

DeFi: Typically lower fees and near-instant settlements, though this can vary depending on blockchain congestion.

In short, DeFi aims to create a more open, inclusive, and transparent financial system using blockchain technology.

I hope you learn something new

Good luck 🫶