The key is to have a strategy, one that balances risk, rewards, and long-term growth. Here’s my step-by-step guide to building a profitable crypto portfolio from scratch

1. Set Clear Investment Goals

Before buying your first coin, ask yourself:

• Are you investing for the short term or long term?

• Are you looking for high-risk, high-reward assets, or do you prefer stability?

• How much are you willing to lose without freaking out?

Your goals will shape how you build your portfolio. For example, if you want long-term stability, you’ll allocate more funds to Bitcoin and Ethereum. If you’re after big gains (and big risks), you might add smaller altcoins with high growth potential.

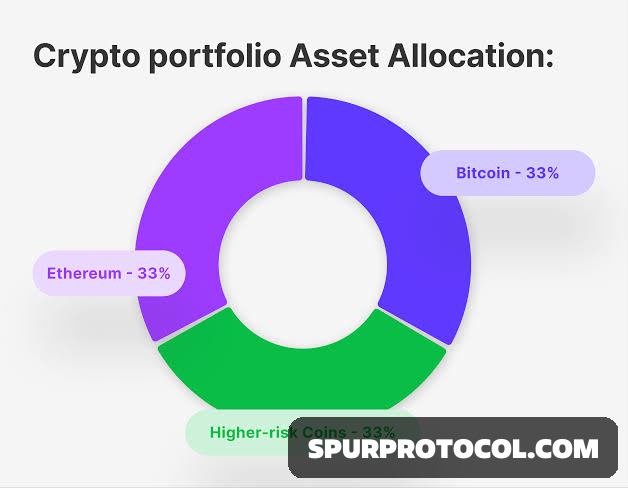

2. Diversify Your Holdings

A solid crypto portfolio isn’t just one coin—it’s a mix of assets that serve different purposes. Here’s a simple way to diversify:

🔹 Large-Cap Cryptos (40-50%)

• These are the “blue-chip” cryptos with strong track records.

• Examples: Bitcoin (BTC), Ethereum (ETH).

• Less volatile, long-term growth potential.

🔹 Mid-Cap Cryptos (30-40%)

• Solid projects that aren’t as big as BTC/ETH but have strong use cases.

• Examples: Solana (SOL), Cardano (ADA), Avalanche (AVAX).

• More risk than Bitcoin but higher potential for growth.

🔹 Small-Cap & Emerging Coins (10-20%)

• Newer projects with high risk but insane growth potential.

• Examples: Layer 2 solutions, AI-related tokens, gaming coins.

• Only invest what you can afford to lose.

🔹 Stablecoins (5-10%)

• Not for growth, but for stability and liquidity during market crashes.

• Examples: USDT, USDC, DAI.

• Allows you to take profits and reinvest when prices dip.

3. Research Before You Invest

Not all cryptocurrencies are worth your money. Before investing, ask yourself:

✅ What problem does this project solve? (Real utility matters.)

✅ Who is behind it? (Strong teams = better chances of success.)

✅ How active is the development? (Frequent updates mean it’s not a dead project.)

✅ What’s the market sentiment? (Look at community support, partnerships, and adoption.)

Always DYOR (Do Your Own Research) before buying any coin. Hype dies fast, but solid projects last.

4. Keep an Eye on Market Trends

Crypto markets move fast. If you’re serious about making profits, stay informed:

• Follow crypto news (CoinDesk, CoinTelegraph, Twitter).

• Track market movements (CoinMarketCap, TradingView).

• Watch for big events (Bitcoin halving, Ethereum upgrades, regulations).

The more you understand the market, the better your investment decisions.

5. Use Dollar-Cost Averaging (DCA)

Instead of throwing all your money into crypto at once, DCA helps you invest in small amounts over time.

🔹 Example: Instead of buying $1,000 of Bitcoin today, you invest $200 per month for five months.

🔹 This strategy reduces risk by averaging your buying price.

🔹 Works great for long-term investors who don’t want to time the market.

6. Secure Your Investments

Your crypto portfolio is only as good as its security. Don’t let hackers or scams ruin your hard work.

🔐 Best Security Practices:

• Use a hardware wallet (Ledger, Trezor) for long-term storage.

• Enable 2FA (Two-Factor Authentication) on all exchanges.

• Never share your seed phrase with anyone—if you lose it, you lose your crypto.

7. Take Profits & Rebalance Regularly

Even the best portfolio needs adjustments over time. As your investments grow:

• Take profits when prices surge (don’t get greedy).

• Rebalance your portfolio to maintain a healthy risk level.

• Sell underperforming assets and move funds into better opportunities.

Crypto is unpredictable, so always stay flexible with your strategy.

Final Thoughts

Building a profitable crypto portfolio isn’t just about picking random coins—it’s about strategy, research, and patience.

✅ Set clear goals

✅ Diversify across different cryptos

✅ Stay informed & adapt to the market

✅ Secure your investments & take profits wisely

The crypto market is full of opportunities, but success comes to those who plan ahead. Start small, stay consistent, and grow your wealth over time.