How To Use Technical Indicator: ADX

How to Use Technical Indicator: ADX

Go Back

🕒 4:50 AM

📅 Jul 12, 2025

✍️ By CRYPTOBNF2

What is ADX Indicator?

ADX is calculated using +DM, -DM, and TR for a default of 14 days period.

ADX is a technical indicator used in trading that measures the DIRECTION and STRENGTH of a particular trend.

ADX Indicator Strategy

ADX consists of 3 components:

ADX Line

+ DI and

- DI

When +DI is above -DI, it indicates bulls are stronger than bears

When -DI is above +DI, it indicates bears are stronger than bulls

When ADX Line is above 20, indicates the trend is strong

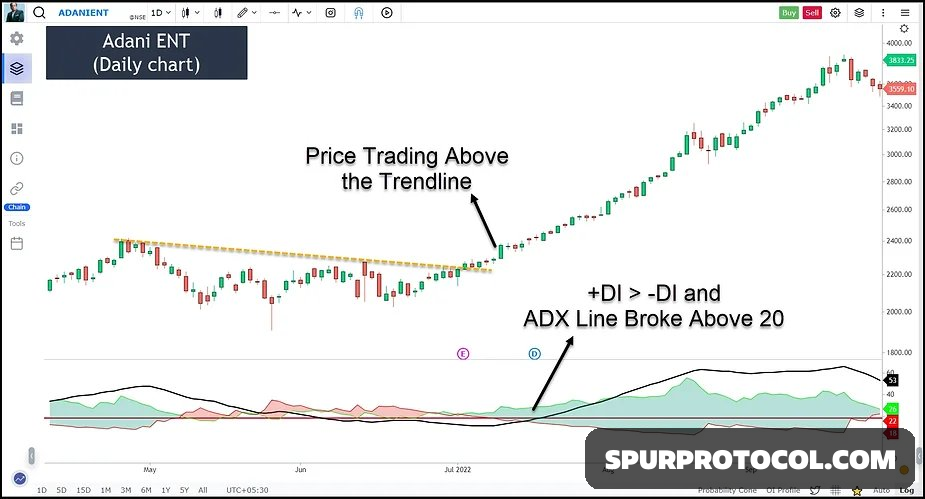

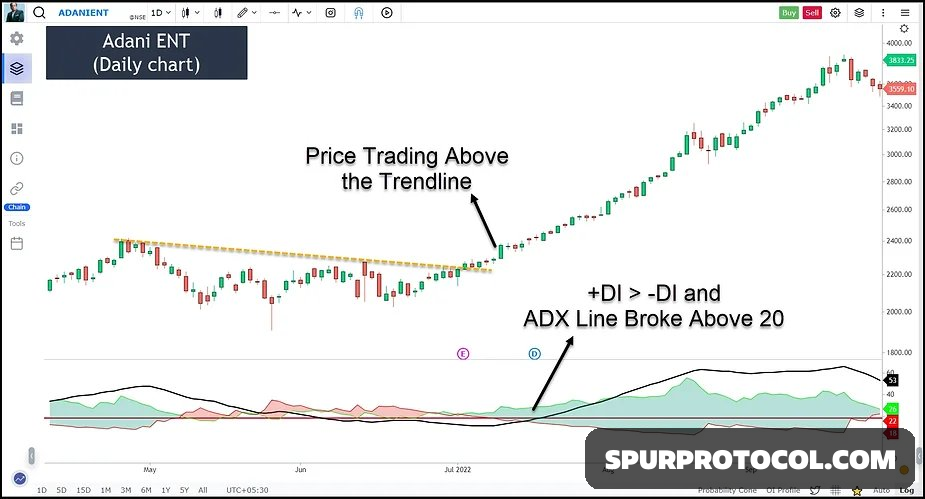

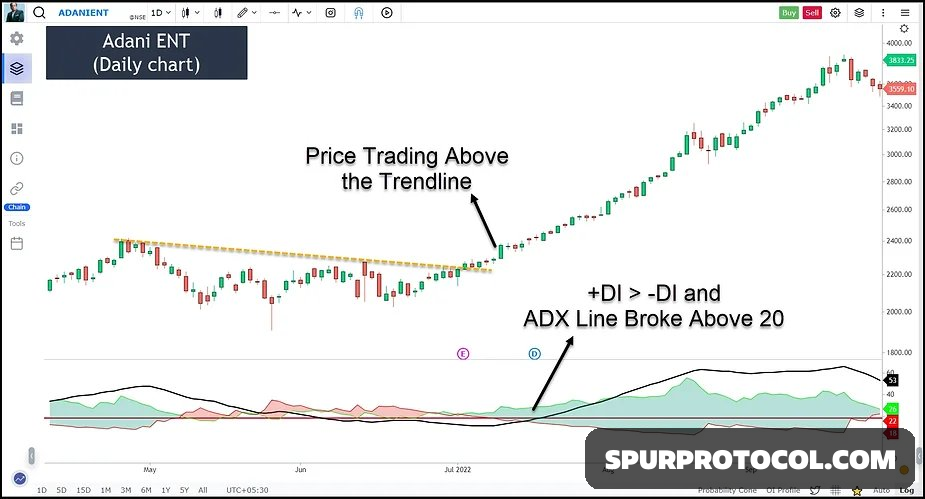

ADX Trade Plan (Long)

Entry:

+DI line is > -DI line & ADX Lines crosses 20

or

ADX line is above 20 & +DI line crosses -DI line from the downside

Entry should come above the high of the candle

SL - Below the low of the entry candle

Target - Next swing high or TSL

ADX Trade Plan (Short)

Entry:

-DI line is > +DI line, and ADX Lines cross 20

or

ADX line is above 20 & -DI line crosses +DI line from the downside

Entry should come above the low of the candle

SL - Above the high of the entry candle

Target - Next swing low or TSL

ADX in Intraday Trading

PDH - stands for Previous Day's High

PDL - stands for Previous Day's Low

IB High - Initial Balance High (First 1-hour high after market open)

IB Low - Initial Balance Low (First 1-hour low after market open)

Long Trade:

Entry: When The price breaks PDH or IB High + ADX line is above 20 & +DI is above -DI

Stop-loss: Below the low of the entry candle

Exit: Target any next resistance zone or TSL

Short Trade:

Entry: When The price breaks PDL or IB Low + ADX line is above 20 & -DI is above +DI

Stop-loss: Above the high of the entry candle

Exit: Target any next support zone or TSL