Most Traders See A Messy Dip And Experienced Traders See A Double Bottom Forming.

Here’s why studying past big winners with double bottoms gives you an edge 👇

Go Back

🕒 9:27 AM

📅 Sep 25, 2025

✍️ By chrison2

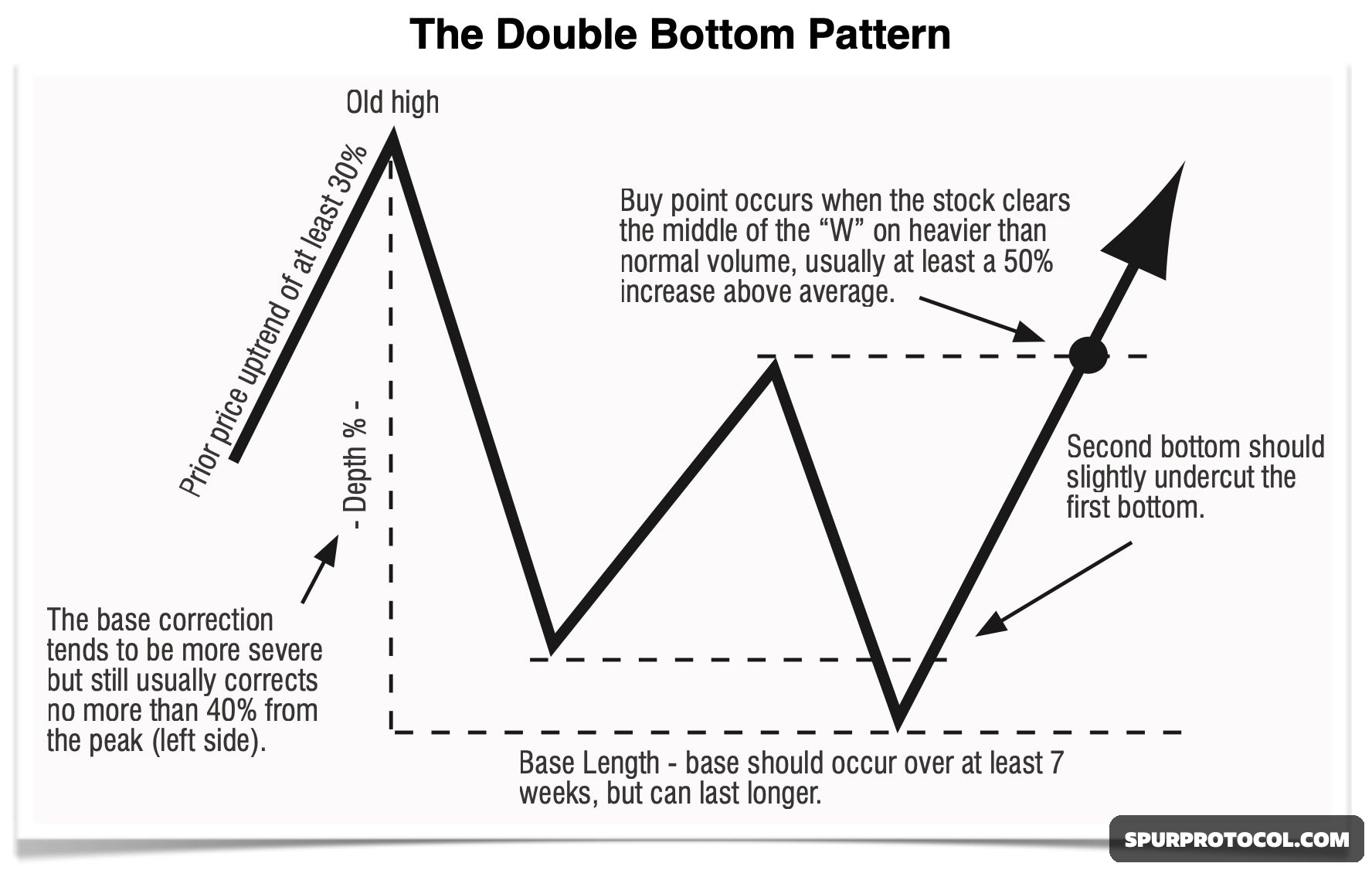

1. Classic Pattern: The first leg down shakes out weak hands. The second bottom tests conviction. Pros wait for structure, not guesses.

2. Undercut & Rally: The second bottom often dips just below the first low, then rips higher. That shakeout sets the stage for strength.

3. Volume Shift: Watch for declining volume into the second bottom, then explosive volume on the breakout. Funds are moving in.

4. RS Strength: Even in correction, leaders hold strong RS vs. the market. Weak names collapse — strong names build structure.

5. Ideal Entry: Buy on the breakout above the middle peak (the “handle” area). That’s where momentum confirms.

Past Examples: Study past big leaders — many had powerful double bottoms before massive runs. Patterns repeat.

Big winners often look ugly before they look great. Study them. Recognize them. Trade them.

I’ve taught this to thousands of traders. You can learn it too.