Options Trading:What Are The Greeks?

The various Greek letters are used in the options market to describe parameters of risk when taking an options position.

Go Back

🕒 10:28 AM

📅 Apr 14, 2025

✍️ By Ecojames

The various Greek letters are used in the options market to describe parameters of risk when taking an options position.

Go Back

🕒 10:28 AM

📅 Apr 14, 2025

✍️ By Ecojames

Options Trading: What Are the Greeks?

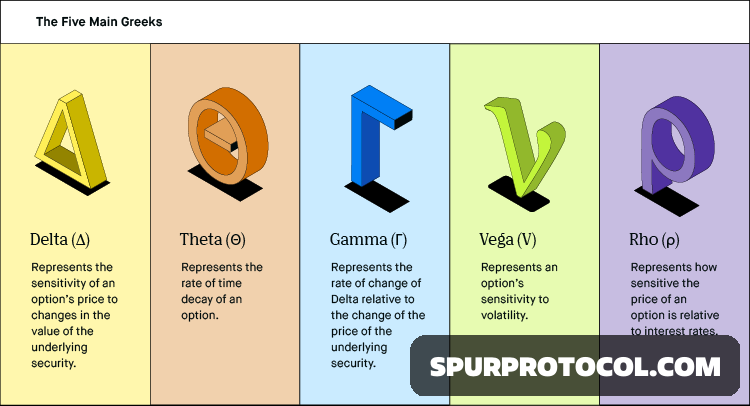

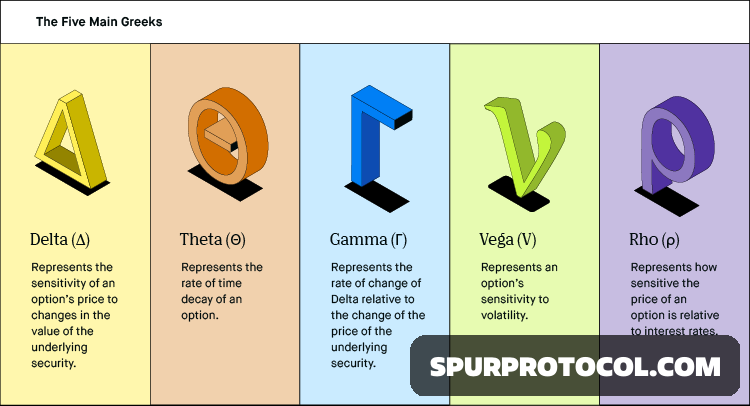

The Greeks — Delta, Gamma, Theta and Vega — are financial calculations that measure an option's sensitivity to specific parameters.

(a.) Delta: shows the rate of change between an option's price and a $1 movement in the underlying asset's price.

(b.) Gamma : measures the rate of change of an options delta, based on a $1 change in the underlying asset's price.

(C.) Theta : measures the sensitivity of an option's price relative to the time it has left to mature (or expire).

(d.) Vega : measures an option's price sensitivity based on a 1% move in implied volatility.

(e.) Rhô : refrects changes in interest rates. Specifically risk free interest rates.

What Are Options Contracts?

-An options contract is a financial instrument that gives you the right — though not the obligation to purchase or sell an underlying asset at a predetermined price (the strike price); it also has an expiration date.

Options contracts fall into two main categories:

(a.) calls and puts. A call option allows its holder to buy the underlying asset at the strike price within a limited timeframe, while a put option enables its holder to sell the underlying asset at the strike price within a limited time frame.

(b.) Options offer both hedging and speculative opportunities, and the parties involved take opposing bearish and bullish positions.

What Are the Different Greeks?

The Greeks help options traders make more informed decisions about their positions and assess their risk. There are four major Greeks used in options trading: Delta, Gamma, Theta, and Vega.

1.Delta

-Delta shows the rate of change between an option's price and a $1 movement in the underlying asset's price. The calculation represents the option's price sensitivity relative to a price movement in the underlying asset.

-Delta ranges between 0 and 1 for call options and 0 and -1 for put options. Call premiums rise when an underlying asset's price increases and fall when the asset's price declines. Put premiums, on the other hand, fall when the underlying asset's price rises and rise when the asset's price drops.

-If your call option has a delta of 0.65, a $1 increase in the underlying asset's price would theoretically increase the option premium by 65 cents. If your put option has a delta of -0.4, a $1 increase in the underlying asset's price would decrease the premium by 40 cents.

2.Gamma

-Gamma measures the rate of change of an options delta based on a $1 change in the underlying asset's price. This makes it the first derivative of delta, and the higher an option's gamma, the more volatile its premium price is. Gamma helps you understand the stability of an option's delta and is always positive for calls and puts

-Example: if your call option has a delta of 0.6 and a gamma of 0.2. The underlying asset’s price increases by $1, and its call premium by 60 cents. The option's delta then also adjusts upwards by 0.2 to 0.8.

3.Theta

-Theta is a representation of the rate of change between the option price and time.

- This is also known as time sensitivity, or time decay. The theta is a representation of how much an option’s price will decrease as the expiration of the option nears, with all else considered equal.

- For example, if a trader has a long position in an option with a theta of 0.6 it is presumed the price of the option will decrease by $0.60 each day, with all else being assumed equal.

-The closer an option is to being in the money, the closer theta will be to zero. Long calls and puts have a negative theta, while short calls and puts have a positive theta. Options also have accelerated time decay as they get closer to their expiration. As a comparison, an asset that does not have price eroded by time will always have a theta of zero.

4.Vega

-Vega is a measure of the rate of change in the implied volatility of the underlying asset and the option value.

- In other words, it is the sensitivity the option has to volatility of the underlying. Vega indicates how much the price of an option will change given a 1% change in the volatility of the underlying asset.

- For example, if an option has a vega of 0.2 it implies the price of the option will change by $0.20 for every 1% change in volatility for the underlying.

-Increased volatility of the underlying also increases the probability of the asset reaching extreme values. This increases the value of an option on that underlying asset. Conversely a decrease in volatility negatively impacts the price of an option. Vega is highest in options that are at-the-money with a long period of time until expiration.

5.Rho

-Rho reflects changes in interest rates, specifically the “risk-free” interest rate, typically a Treasury bill with a maturity date that aligns with the option’s expiration date. Why? The premium paid for an option requires a cash outlay, which means that money is tied up ( unable to earn interest).

Unless you’re buying or selling a long-term option that expires many months or even years from now and most of the trading volume in the options market is in expiration dates of two months or less rho isn’t a closely monitored risk component.