Stop Limits In Crypto Trading Explained

There are 2 Types of stop limits:

Go Back

🕒 9:53 PM

📅 Jun 03, 2025

✍️ By Balenkey

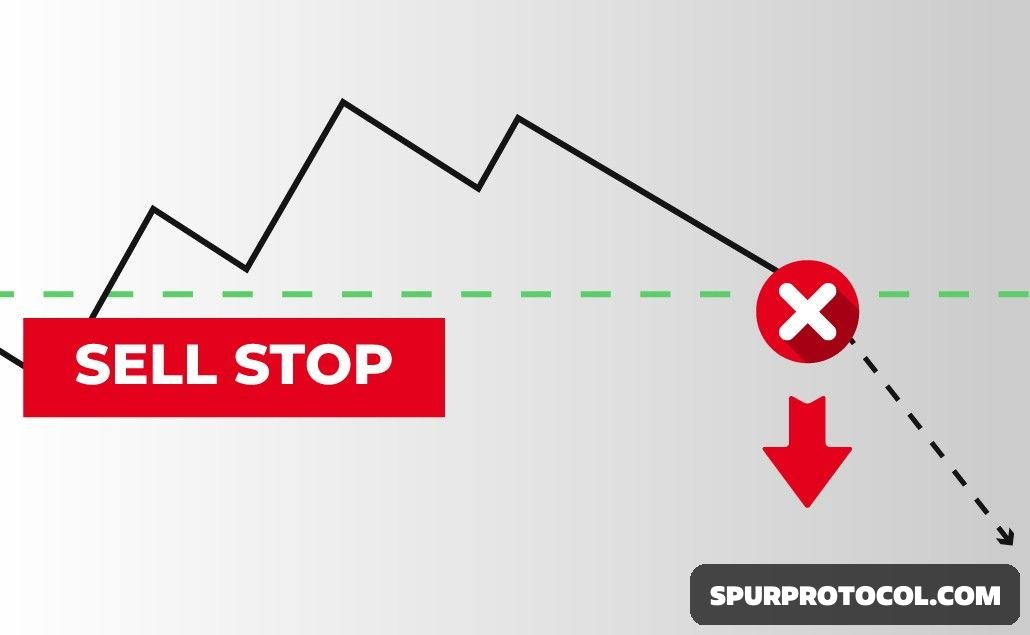

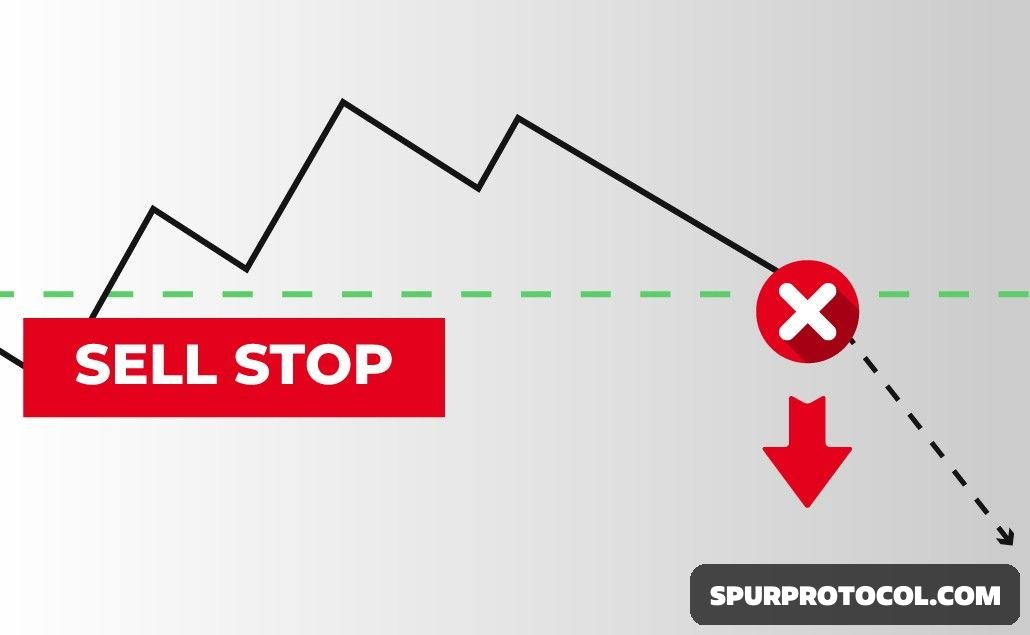

1) BUY Stop Limit2)SELL Stop Limit

When inputting a stop limit you enter the,

• “STOP” price

• “LIMIT” price

The stop price is the price that the order will be created if triggered.

If the price of the coin never hits the stop price, the sell order will never be created.

The limit price is the price the coin will sell.

Advantages of stop limits:

✅ You have better control on when the order is placed

✅ Secures Profits

✅ Manages Risk

✅ Safeguards you from corrections and makes you ready to re-buy at the lower prices

✅ It allows for less time spent monitoring daily and hourly price actions

Example;

XDB / USDT

Current Price: $0.080

My TA tells me the price may start to fall rapidly if it breaks the next support level at $0.070.

I create a Stop Limit order:

STOP: @$0.070

LIMIT: @$0.065

If the price of XDB hits $0.070 the STOP price is triggered and the sell order is created to sell at $0.065.

If the price of XDB hits $0.065 it automatically sells.

If the price never hits $0.070 the order is never created.

If the price hits $0.068, then rises back up, the order is created but is never sold as it never hit the LIMIT price of $0.065.

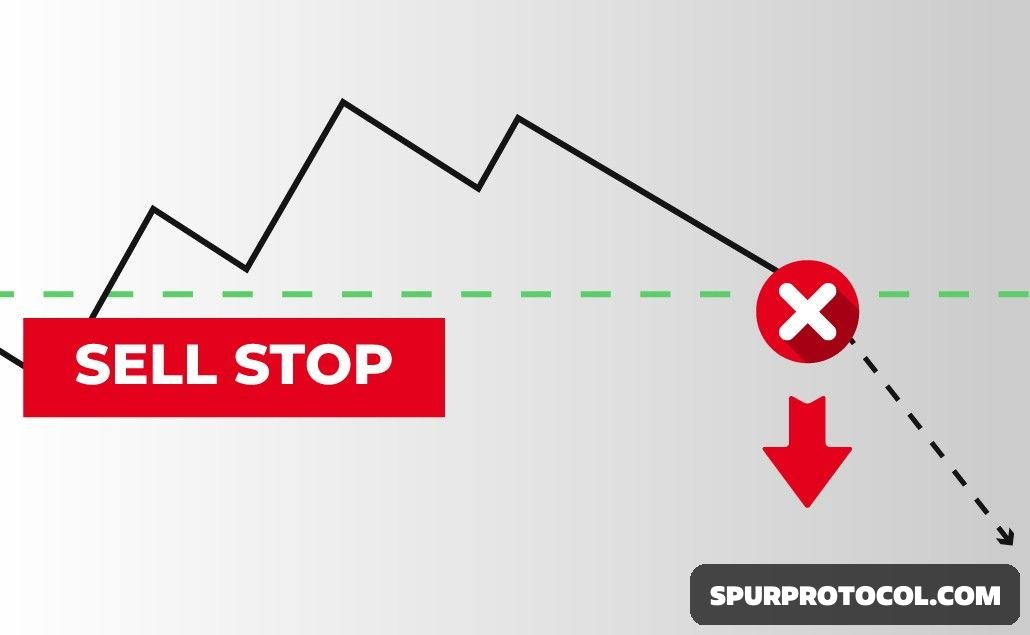

With BUY Stop Limits it is the same concept but the STOP price creates a buy order and the LIMIT price executes the BUY order.

#STOPLIMIT