Tariff: Meaning, Types, And Impact

What is a Tariff?

A tariff is a tax or duty imposed by a government on imported or exported goods.

Go Back

🕒 9:50 AM

📅 Apr 02, 2025

✍️ By Clovremix

Tariff: Meaning, Types, and Impact

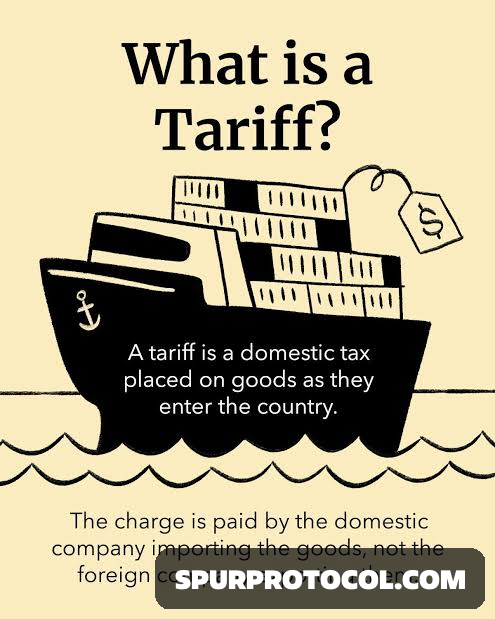

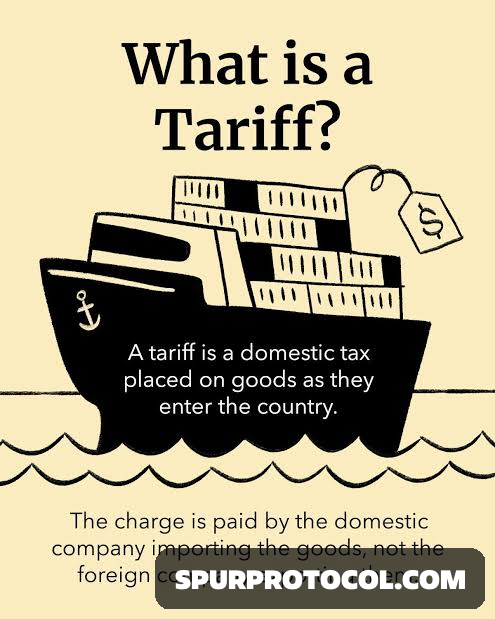

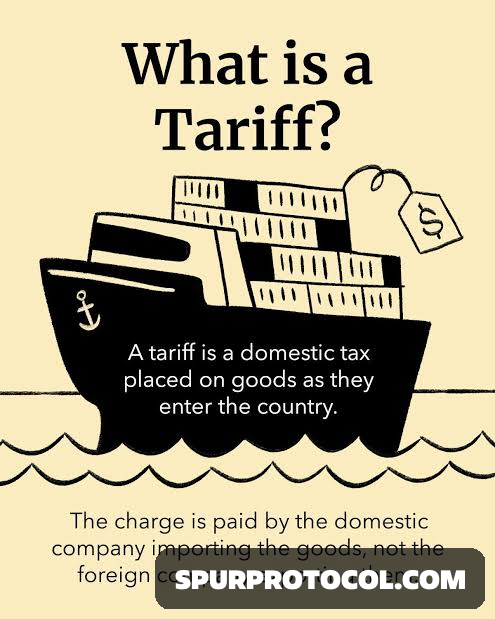

What is a Tariff?

A tariff is a tax or duty imposed by a government on imported or exported goods. The primary purposes of tariffs are:

- To generate revenue for the government.

- To protect domestic industries by making foreign goods more expensive.

- To regulate trade by discouraging imports or encouraging exports.

---

Types of Tariffs

1. Ad Valorem Tariff

- A percentage-based tax applied to the value of the imported goods.

- Example: A 10% tariff on imported cars means if a car costs $20,000, the tariff will be $2,000.

2. Specific Tariff

- A fixed amount charged per unit of goods, regardless of their value.

- Example: A $5 tariff on each bottle of imported wine.

3. Compound Tariff

- A combination of both ad valorem and specific tariffs.

- Example: A car may have a $500 fixed tariff plus a 5% tax on its value.

4. Protective Tariff

- Imposed to protect domestic industries from foreign competition by making imports more expensive.

5. Revenue Tariff

- Aimed at generating income for the government rather than protecting domestic industries.

6. Prohibitive Tariff

- So high that it effectively prevents imports.

7. Retaliatory Tariff

- Imposed in response to another country’s tariff on domestic goods.

8. Anti-Dumping Tariff

- Levied on foreign goods sold below market price to prevent unfair competition.

---

Effects of Tariffs

1. On the Economy

- Positive Impact:

- Protects domestic industries.

- Generates government revenue.

- Encourages local production and job creation.

- Negative Impact:

- Increases prices for consumers.

- Reduces trade and economic efficiency.

- May lead to trade wars if other countries impose retaliatory tariffs.

2. On Businesses

- Domestic Businesses: Benefit from reduced foreign competition.

- Importers & Exporters: Face higher costs and reduced market opportunities.

3. On Consumers

- Higher prices for imported goods.

- Limited product choices.

---

Examples of Tariffs in Action

- U.S. vs. China Trade War (2018-2020): The U.S. imposed tariffs on Chinese goods, and China responded with its own tariffs. This increased prices and disrupted global trade.

- EU Tariffs on U.S. Goods: The European Union imposed tariffs on American products in retaliation for U.S. tariffs on steel and aluminum.