Token Allocation 101: Why It Matters For Investors And Traders

Discover how tokens are distributed in crypto projects, why allocation matters, what red flags to watch out for, and how smart vesting can protect your investments. Learn to spot fairness, decentralization, and long-term potential through proper tokenomics

Go Back

🕒 2:15 PM

📅 Jul 04, 2025

✍️ By DRDEBBY

🔵 What Is Token Allocation?

Token Allocation refers to how the total supply of a cryptocurrency (or token) is divided and distributed among different groups or purposes when a crypto project is launched.

It’s basically the token distribution plan: who gets what, how much, and when.

🎯 Why Token Allocation Matters

Understanding token allocation helps investors and community members know:

📌 Who controls most of the tokens

📌 How tokens are released over time (vesting)

📌 If a project is fairly or unfairly structured

📌 If there's a risk of sudden dumps or price crashes

⚠️ A bad allocation can signal greed or centralization. A good one shows fairness and long-term thinking.

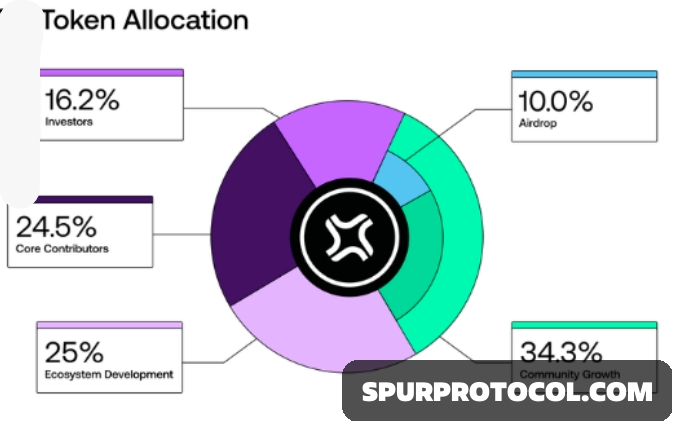

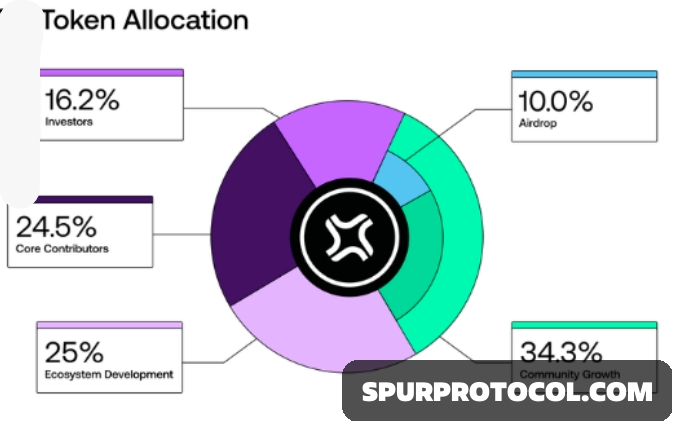

🔵 Common Token Allocation Categories

Below 👇 are the typical categories in most crypto projects:

📌 Team & Founders: Reward for building the project.

Usually locked and vested over years to prevent dumping.

~10–20% of total supply.

📌 Investors (Seed, Private & Public Sale): Tokens sold to raise funds during early stages.

Different rounds have different pricing and vesting.

~10–30% total supply.

📌 Community & Ecosystem

For growth: giveaways, partnerships, incentives, airdrops, staking rewards.

Encourages adoption and decentralization.

~20–50% total supply.

📌 Reserves or Treasury: Held for future use like partnerships, development, or emergencies.

Usually locked but flexible.

~10–20%.

📌 Advisors & Partners

People who helped guide the project early.

Typically small share and vested.

~2–5%.

🔵 Vesting & Lockups — Preventing Token Dumps

📌 Projects often lock and vest tokens to avoid sudden release and selling (which causes price crashes).

📌 Lockup = Tokens can't be accessed for a set time.

📌 Vesting = Tokens are released gradually (e.g., 10% per month for a year).

This ensures long-term commitment from team members and investors.

🚩 Red Flags in Token Allocation

🚫 Too much team or insiders (40%+)

🚫 No vesting schedule

🚫 Low community allocation

🚫 Unclear or hidden tokenomics

📌 These can lead to centralization or token dumps.

🔵 What You Should Look For as a Trader/Investor

📌 Transparent token allocation chart or pie chart

📌 Clear vesting schedules

📌 High community & ecosystem allocation

📌 Reasonable founder and investor shares

📌 Regular updates and transparency

🔵 Summary;

📌 Token Allocation = the foundation of a project’s economy.

📌 A well-structured allocation shows fairness, trust, and a long-term vision.

Always check it before investing or joining a project.

📌 Remember: Who holds the tokens... holds the power.