Token Unlock And How It Affects Your Holdings/investment

Token Unlock; important things to know before it happens

Go Back

🕒 9:09 AM

📅 Nov 30, 2025

✍️ By SNOWMAN

A token unlock means that tokens previously locked to reduce circulating supply (e.g., team allocations, investor tokens, ecosystem rewards) will become available for trading.

Here’s what this usually means for prices:

1. Token Unlocks Often Create Selling Pressure

When a large number of tokens enter circulation, early investors, teams, or private-sale buyers may sell to take profit, which is logical as they've been holding for long.

This increases supply.

📉 More supply + same demand = potential price drop

The risk is higher if:

👉🏽 There's no strong utility which can increase demand, and help a quick recovery even if the team and early investors take some profit.

👉🏽The unlock is large compared to market cap

👉🏽The token has low liquidity

👉🏽The market is bearish

🧮 2. The percentage unlocked matters

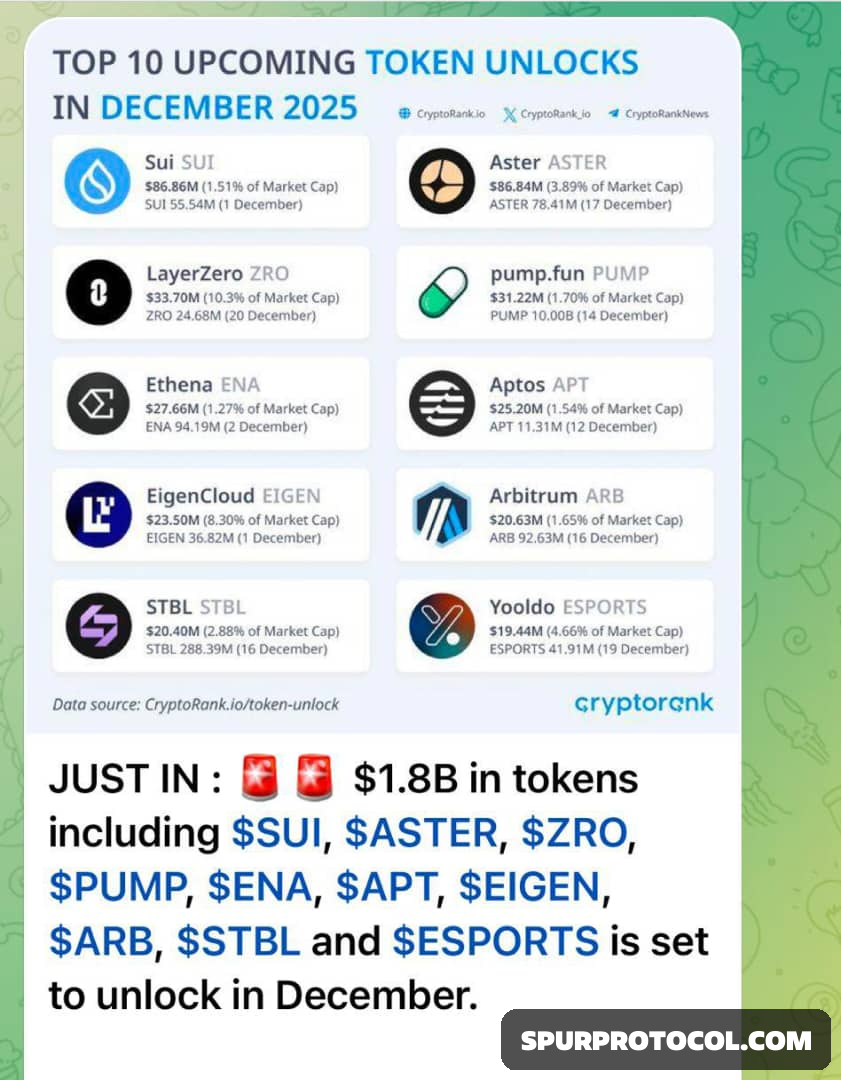

Let’s look at a few examples from the image:

#Sui ( $SUI )

Unlock: $86.86M (1.51% of market cap)

➡️ Low % unlock → usually mild impact

#LayerZero ( $ZRO )

Unlock: $33.7M (10.3% of market cap)

➡️ Very high → strong selling pressure likely

#Aster ( $ASTER )

Unlock: 3.89%

➡️ Moderate → possible dip

$STBL

Unlock: 2.88%

➡️ Mild–moderate impact

#EigenCloud ( $EIGEN )

Unlock: 0.30%

➡️ Very low → usually minimal impact

📌 3. Investors react BEFORE the unlock

Most traders sell ahead of the unlock or avoid buying until after the event.

🧭 4. What it means for YOU

✔ If you’re holding:

High probability of seeing a downtrend leading into the unlock & high volatility on the unlock day.

✔ If you’re looking to buy:

Smart traders often wait until after unlocks to buy cheaper.

✔ If you’re trading short-term:

Unlock days often create temporary dips ideal for shorts. Notwithstanding, apply caution cause some devs often do a fake pump around that period to wave off any panic, just before the major dump.