TVL PT2. What Are The Benefits And Limitations Of TVL

"The continuous improvements in the crypto industry have introduced many unprecedented benefits and challenges. Cryptocurrencies arrived with a solid claim for transforming conventional financial infrastructures, systems, and processes."

Go Back

🕒 6:16 PM

📅 Sep 06, 2025

✍️ By kihole

The following are the benefits of TVL IN Cryptocurrency.

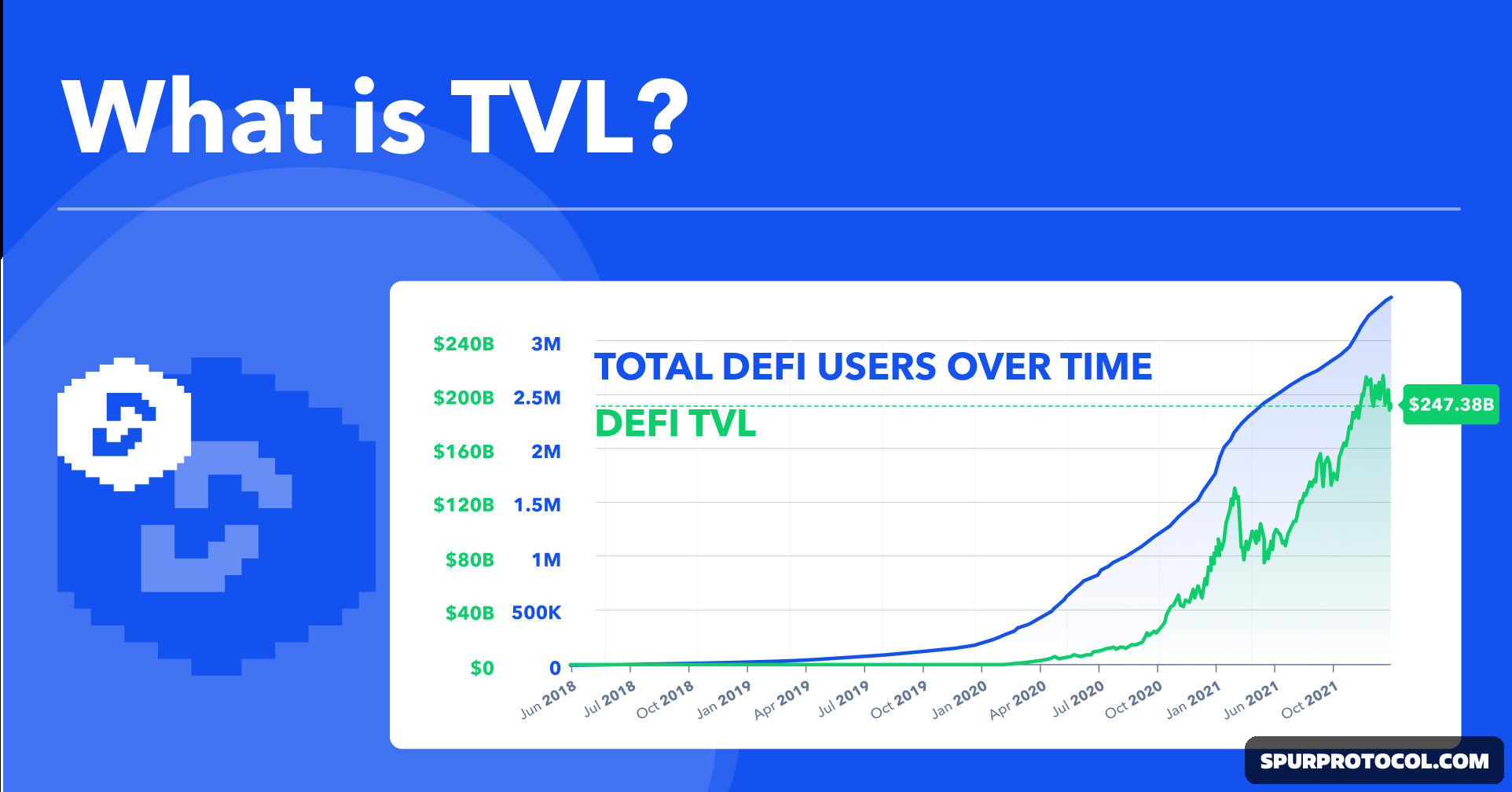

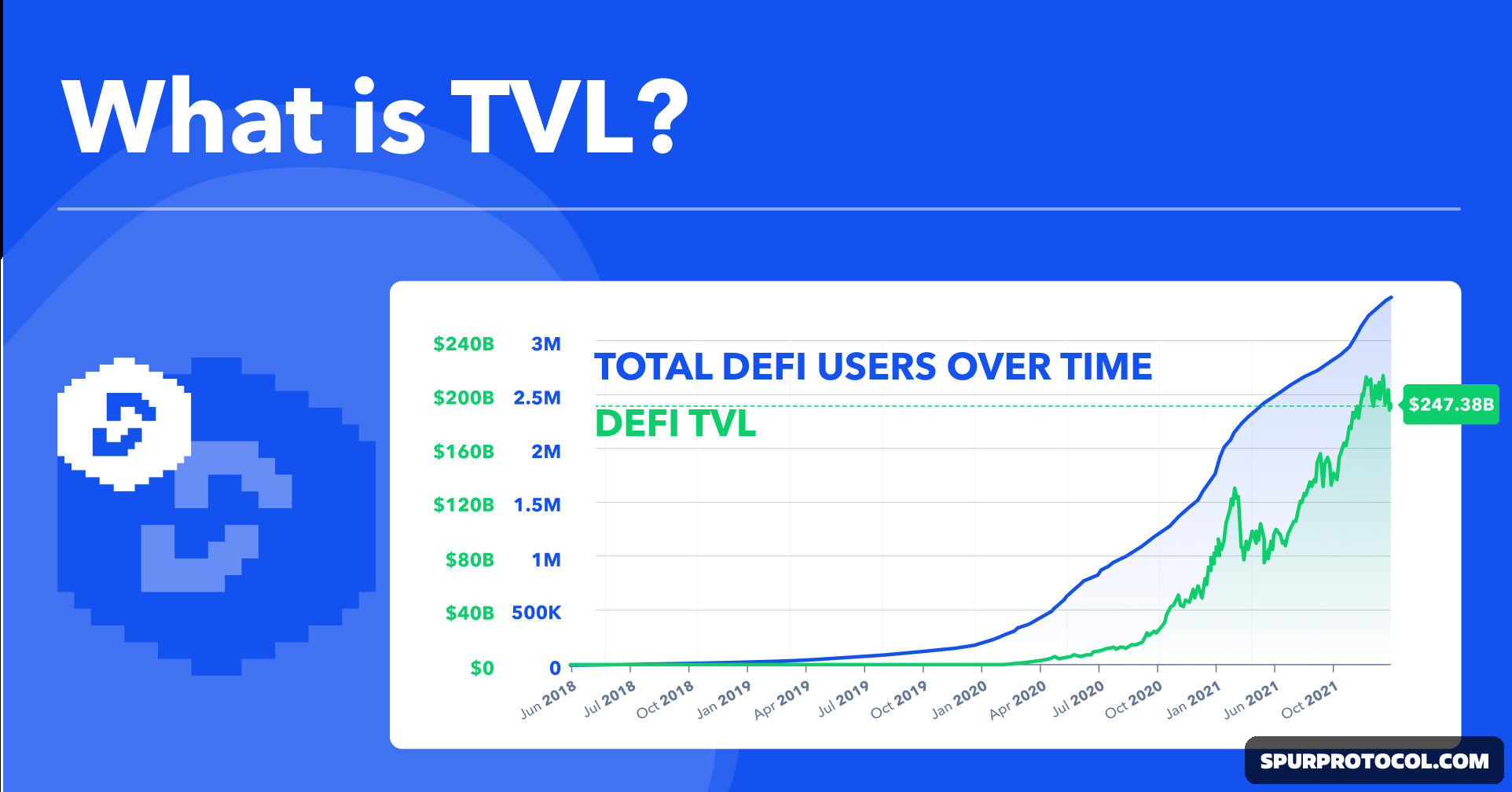

1. It shows the existing state of total locked assets in Defi.

Before you dive deeper into questions like “How important is TVL?” you need to check the existing state of TVL

2. Attractant to investors

A better TVL is an obvious indicator of effective usability for investors and traders.

3. Liquidity and popularity of Defi protocols

The growth in TVL for a particular DeFi protocol brings about plausible improvements in usability, liquidity, and popularity for the platform.

4. Higher TVL indicates that a DeFi protocol has more capital locked in the platform.

Limitations of TVL

TVL only provides a glimpse of the total value of assets that are locked in a platform, it doesn’t highlight activity levels.for example

If a platform has a high TVL but low user-activity levels, this may mean that a small number of investors account for the TVL on that platform.

Generally, this is a red flag and would require more investigation.

The DeFi industry isn’t immune to the collapse of trusted institutions, as was evident with the $60 billion collapse of the Terra (LUNA) lending protocol in 2022. This highlighted another problem with TVL: The assets involved in the calculation may not be as secure as believed.

The Bottom line according to an article on Investopedia, "Total value locked (TVL) serves as a crucial indicator in the cryptocurrency industry, helping investors assess the security and popularity of decentralized finance (DeFi) platforms. A platform with a high TVL suggests strong investor trust, similar to deposits in traditional banking. However, TVL should be used alongside other metrics, as it does not directly account for user activity and can sometimes be artificially inflated. Investors are advised to perform deeper due diligence, looking into a platform's reputation and operational transparency, before making financial decisions. Be mindful that the DeFi space can be unpredictable, with significant risks, as demonstrated by past events like the Terra collapse."