As act like dynamic support/resistance.

→ Price often bounces off key MAs like 50, 100, and 200.

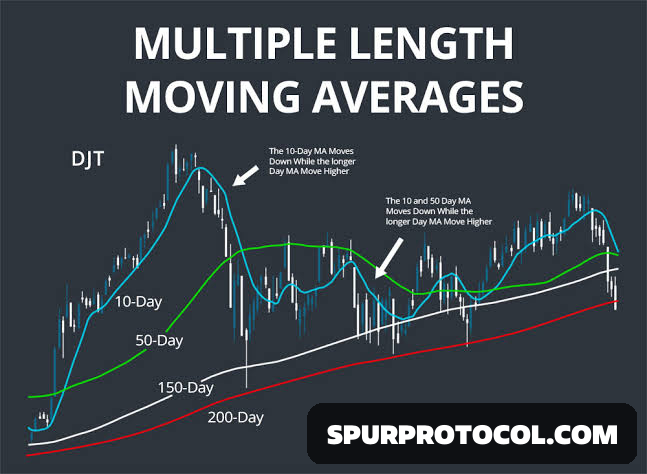

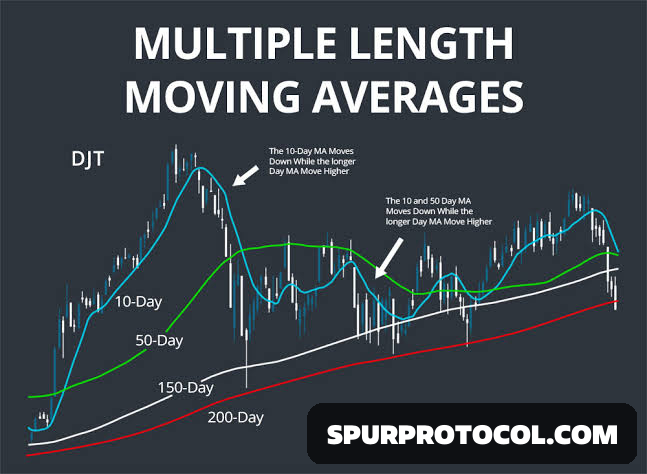

Shorter MAs react faster, but give more false signals.

→ Use 5–13 MA for entries, but confirm with structure.

Crossovers signal momentum shifts.

→ Golden Cross = Bullish (50 MA crosses above 200 MA)

→ Death Cross = Bearish (50 MA drops below 200 MA)

Tight MA clusters = explosive moves coming.

→ When 5-8-13 MAs compress, expect breakout soon.

Pullbacks to long-term MAs are high-probability zones.

→ Smart money often reloads near the 100 or 200 MA.

Use MAs with price action, not blindly.

→ Always check structure, volume, and context.

Rising MAs = uptrend. Falling MAs = downtrend.

→ Helps you avoid trading against the tide.

The steeper the MA slope, the stronger the trend.

→ Flat MAs = choppy, avoid overtrading.

Master the rhythm of MAs and you'll never feel lost in a trend again