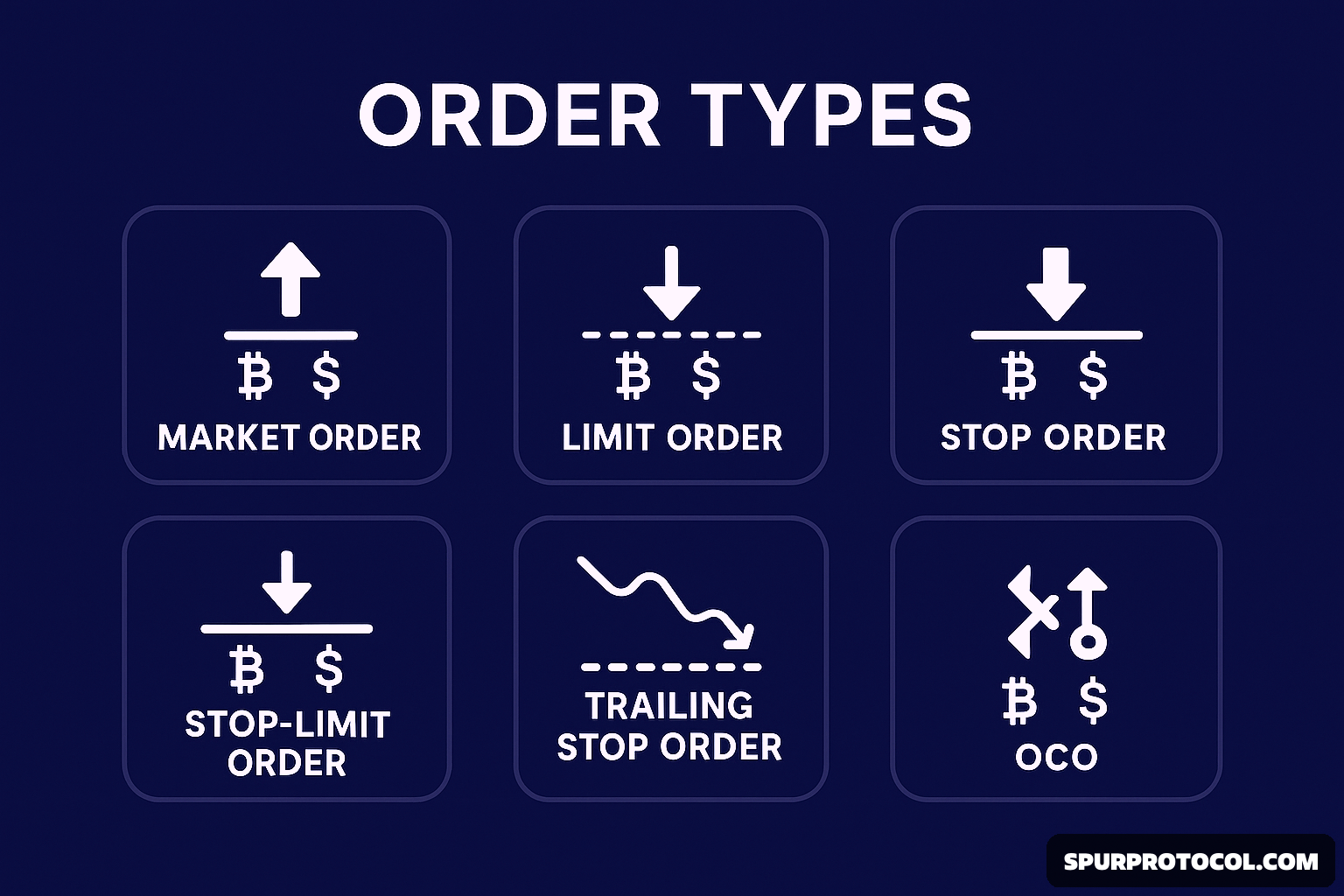

Different order types let you control how your trades are executed based on your goals—whether you want speed, the best price, profit-taking, or risk control. If you don't know the right order type to use, you could either miss out on a good deal or lose more than you planned.

Let’s break down the most common order types:

1. Market Order

A market order buys or sells crypto immediately at the best available price. It’s fast but doesn’t guarantee a fixed price—you just take what the market offers.

Example:

You want to buy 1 Bitcoin now. You use a market order, and it gets filled instantly at around $65,000. The price might be a little higher or lower depending on how fast the market is moving.

2. Limit Order

A limit order lets you set the exact price you want to buy or sell at. It only goes through when the market reaches that price. This gives you more control over the deal.

Example:

You want to buy 1 BTC but only if it drops to $60,000. You place a limit order at that price. If the price never hits $60k, nothing happens. If it does, your order fills automatically.

3. Stop Order (Stop-Loss Order)

A stop order is used to reduce loss or protect your gains. It triggers a market order when the price hits a certain level (the stop price).

Example:

You bought Ethereum (ETH) at $3,000. To protect your money, you set a stop order at $2,800. If ETH falls to $2,800, your coins are sold at the best market price, helping limit further loss.

4. Stop-Limit Order

This type combines a stop order and a limit order. Once your stop price is hit, a limit order is placed—giving you more control over how much you’re willing to sell or buy for.

Example:

You want to sell ETH if it falls to $2,800 but not lower than $2,750. You set a stop at $2,800 and a limit at $2,750. If ETH drops to $2,800, your limit order activates. But if ETH suddenly crashes below $2,750, the order may not be filled.

5. Trailing Stop Order

This is a dynamic stop order. It moves with the market price to help lock in profits while protecting against sudden reversals.

Example:

You buy BTC at $60,000 and set a trailing stop of $1,000. As BTC rises to $66,000, your stop moves to $65,000. If the price then drops to $65,000, it sells automatically—locking in profits without you having to watch the chart constantly.

6. OCO (One-Cancels-the-Other)

An OCO order places two orders at the same time: one limit order (for taking profit) and one stop order (to prevent loss). When one triggers, the other is automatically cancelled.

Example:

You bought BTC at $60,000. You place a limit sell at $70,000 (to take profit) and a stop sell at $58,000 (to cut loss). If BTC hits $70,000, the profit order is filled and the stop is cancelled. If BTC drops to $58,000, the stop order sells, and the profit order is cancelled.

Advanced Order Types (Bonus)

These aren’t always available on every platform, but they’re useful for more advanced strategies:

7. Fill or Kill (FOK)

This order must be filled entirely, and immediately. If not, it gets cancelled.

Example:

You want to buy 5 BTC right now—no partial fills. You use a FOK order. If the market can’t provide all 5 instantly, the whole order is cancelled.

8. Immediate or Cancel (IOC)

This one tries to fill your order immediately, even if only partially. Anything unfilled is cancelled.

Example:

You place an IOC order to buy 5 BTC. The market fills 3 BTC instantly, but the rest can’t be matched. So 2 BTC is cancelled.

9. Post Only

This ensures your order adds liquidity by going into the order book. If it would immediately match an existing order, it’s rejected.

Example:

You place a post-only limit order to sell ETH at $3,100. If someone already wants to buy at that price, your order is rejected. This helps you avoid paying taker fees.

10. Reduce Only

Mostly used in futures or margin trading. It ensures your order only reduces your current position, never increases it.

Example:

You’re long 2 BTC in a futures trade. You place a “reduce-only” sell order for 1 BTC. If the system detects this would open a short position instead of just reducing your long, it cancels the order.

11. Time-Based Orders: GTC & GTD

These aren’t different ways to buy or sell but tell the system how long to keep your order active.

GTC (Good Till Canceled): Order stays open until you cancel it.

GTD (Good Till Date): Order stays open until a specific date/time.