What Are Atomic Swaps?

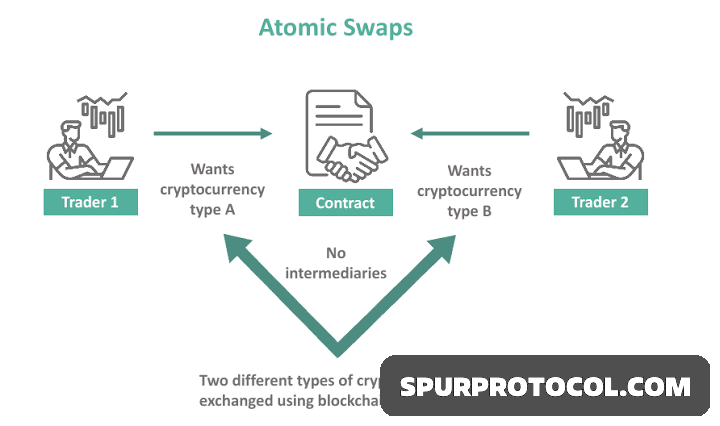

Atomic Swaps are a peer-to-peer, trustlessly methods of exchanging coins on different blockchains

Go Back

🕒 6:57 PM

📅 May 07, 2025

✍️ By Ecojames

-Atomic Swaps refers to the techniques that allow tokens from different contracts which may run on the same or different contracts which may run on the same or different blockchains, to be securely traded such that both parties succeed or fail together in getting the offered tokens.

How Atomic Swaps work

- Judy wants to trade 100 A-Tokens with James for 50 B-Tokens

- Judy generates a random secret and generates its SHA256 hash. Judy gives that hash to James.

- Judy deposits 100 A-Tokens into the HTLC contract and designate James as the beneficiary, the tokens are locked with the hash

- James responds by depositing 50 B-Tokens into the HTLC and designate Judy as the beneficiary, the tokens are also locked with the same hash James has obtained from Judy

- Judy has the original secret that was used to produce the hash (called a pre-image), so Judy uses it to call the claim function on the HTLC contract to claim the trade payment and fully receive the 50 B-Tokens from James. By doing so, Judy necessarily reveals the pre-image in the transaction input, which becomes visible to James.

- James uses the pre-image to finalize his payment from Judy.

Advantages of Atomic Swaps

1. Decentralized nature

Cryptocurrency traders tend to advocate for a decentralized financial world but still need to trade using centralized exchanges, such as Coinbase. By being independent of exchange platforms and allowing for direct, wallet-to-wallet transactions

2. Increased security

The HashLock and TimeLock technologies in HTCL contracts employed by atomic swaps offer greater security and assurance to traders – since they have the guarantee of getting their currency back in case of delays or conflicts.

3. Peer-to-peer trading and lower costs

In addition to allowing people to trade with each other independently, atomic swaps reduce operational costs and trading fees that are associated with using centralized exchange platforms.

4. Increased altcoin trading flexibility

Exchange platforms, such as Coinbase, do not allow traders to exchange all types of altcoins, e.g., Ripple (XRP), cannot be traded directly for Litecoin on Coinbase. It must be turned into Bitcoin, and then it can be exchanged for Litecoin. Atomic swaps solve such a problem by allowing almost all types of altcoins to be traded.

Disadvantages of Atomic Swaps

1. Complexity and conditions

Since they offer higher security, atomic swaps come with trade conditions that are more stringent than those imposed by exchange platforms, and they require parties to interact without means of direct communication .

2. Privacy issues

Atomic swaps can take time to execute (depending on the timeframe of the TimeLock). As a result, the transaction is active on the blockchain network for longer times, giving hackers more time to interrupt the process and gather private information about traders.

3. Lack of a centralized platform

Despite all the disadvantages associated with using centralized platforms, atomic swaps do not offer the same amount of convenience that trading platforms do especially when it comes to exchanging fiat currency for cryptocurrency which cannot be done through atomic swaps.