What Are Lending And Borrowing Protocols In DeFi?

What are the basic concepts and benefits of Lending and borrowing Protocols in DeFi

Go Back

🕒 2:53 PM

📅 May 22, 2025

✍️ By oluwafemighty

What are the basic concepts and benefits of Lending and borrowing Protocols in DeFi

Go Back

🕒 2:53 PM

📅 May 22, 2025

✍️ By oluwafemighty

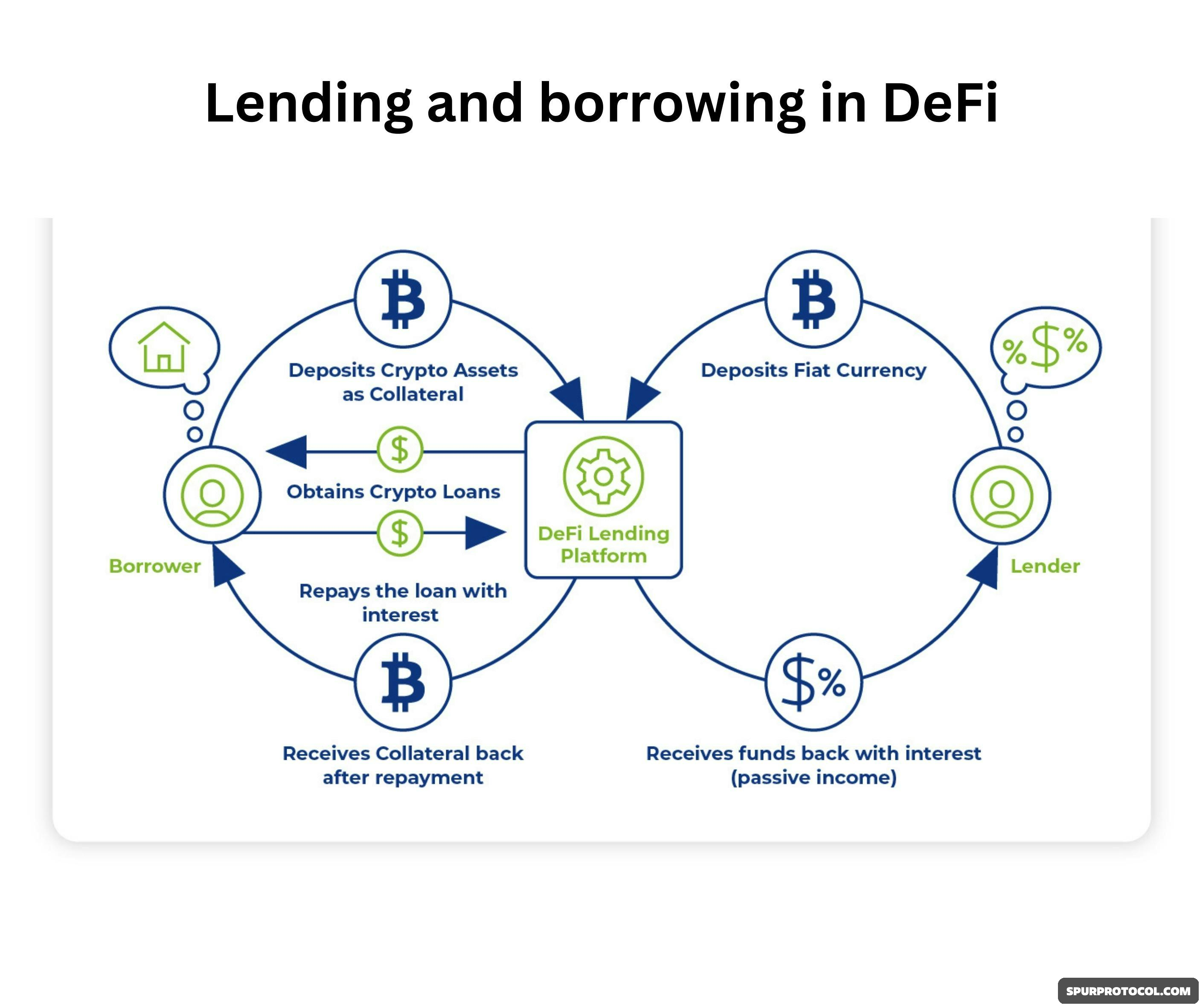

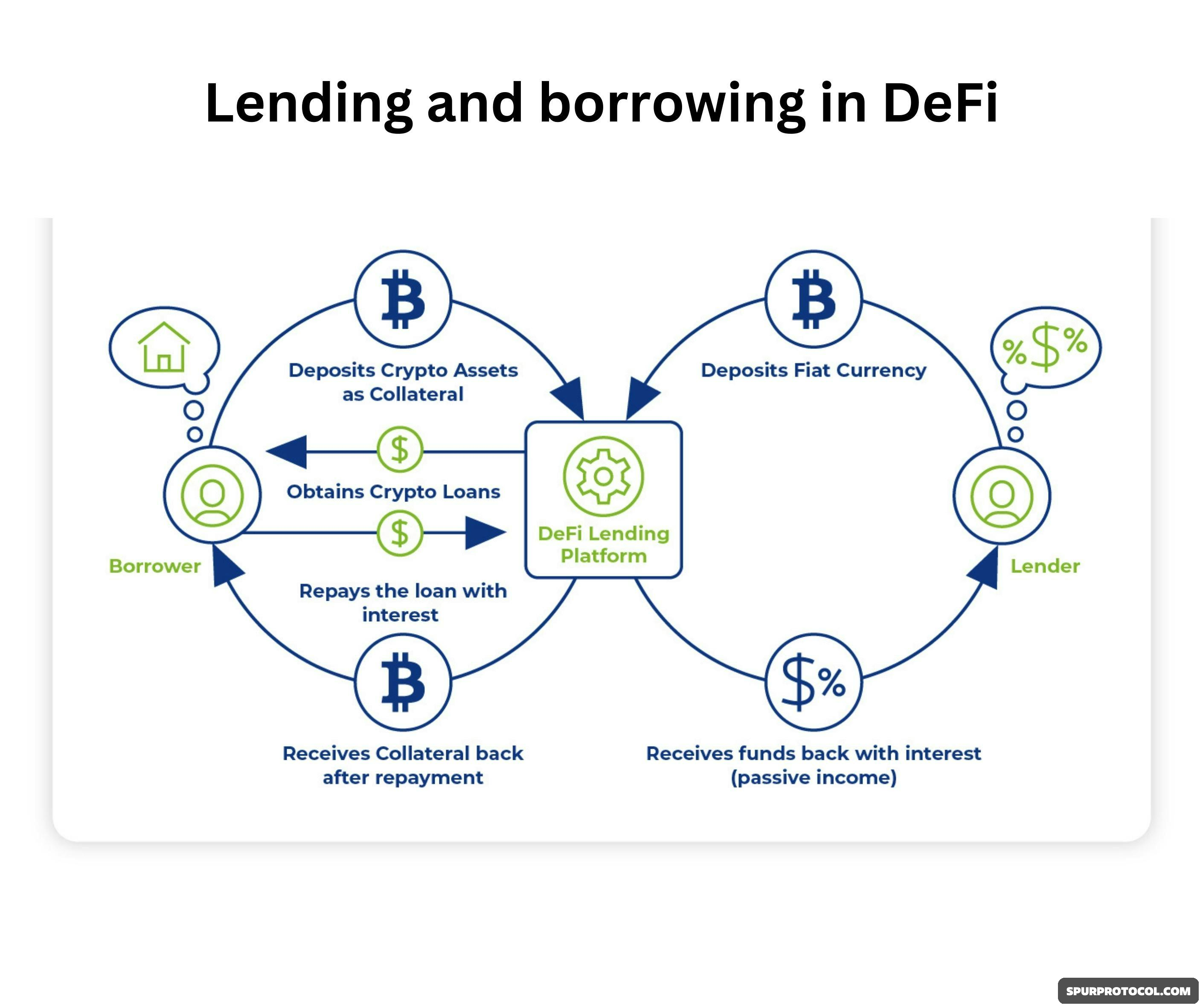

Lending and borrowing protocols in DeFi (Decentralized Finance) are blockchain based platforms that allow users to lend or borrow cryptocurrencies without intermediaries like banks. These protocols use smart contracts to automate and secure transactions

How They Work:

Lending:

1. Users deposit crypto assets into a liquidity pool.

2. These deposits earn interest, paid by borrowers.

3. The interest rate is typically variable, based on supply and demand.

Borrowing:

1. Users collateralize their loans by locking up crypto (usually worth more than the loan).

2. They borrow other crypto assets in return.

3. If the value of the collateral drops too much, it may be liquidated to protect the protocol.

Popular DeFi Lending/Borrowing Protocols:

1. Aave: Offers flash loans, stable/variable interest rates, and a wide variety of assets.

2. Compound: One of the earliest lending protocols with algorithmically-set interest rates.

3. MakerDAO: Allows users to lock ETH and mint DAI, a decentralized stablecoin.

4. Venus (on BNB Chain): Combines lending and stablecoin features.

Some of the benefits are:

1. Permissionless: Anyone with a wallet can participate.

2. Non-custodial: Users retain control of their assets.

3. Earning potential: Lenders earn passive income.

Some of the Risk include:

1. Smart contract bugs.

2. Collateral volatility and liquidations.

3. Protocol exploits or governance attacks.

In short, DeFi lending and borrowing protocols democratize finance by enabling users to earn or access capital without a centralized authority.

I hope you learn something new

Good luck 🫶