What Does The Word "flash Loan" Mean?

How does a flashloan works and what are the use cases.

Go Back

🕒 10:19 AM

📅 May 23, 2025

✍️ By oluwafemighty

How does a flashloan works and what are the use cases.

Go Back

🕒 10:19 AM

📅 May 23, 2025

✍️ By oluwafemighty

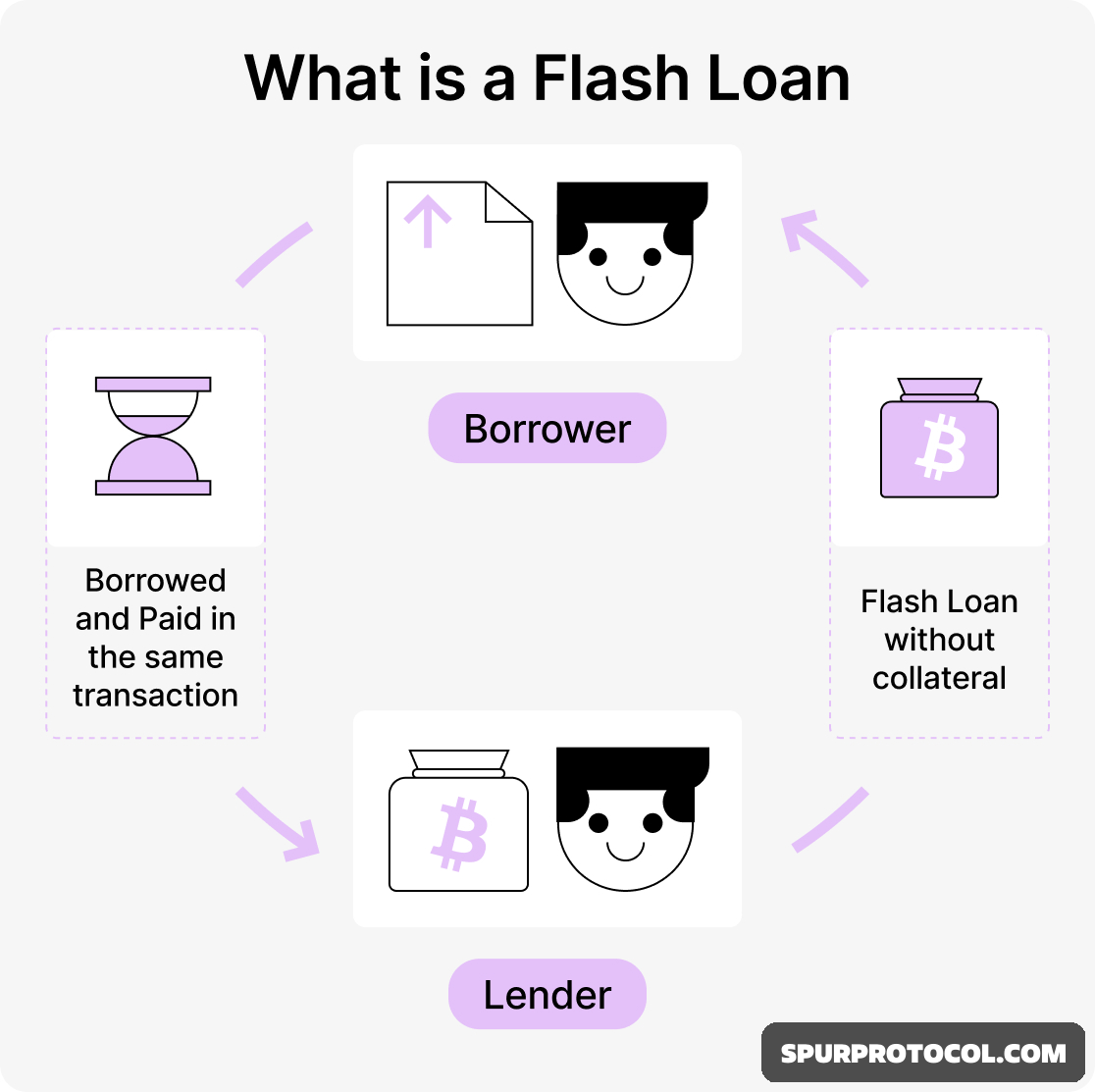

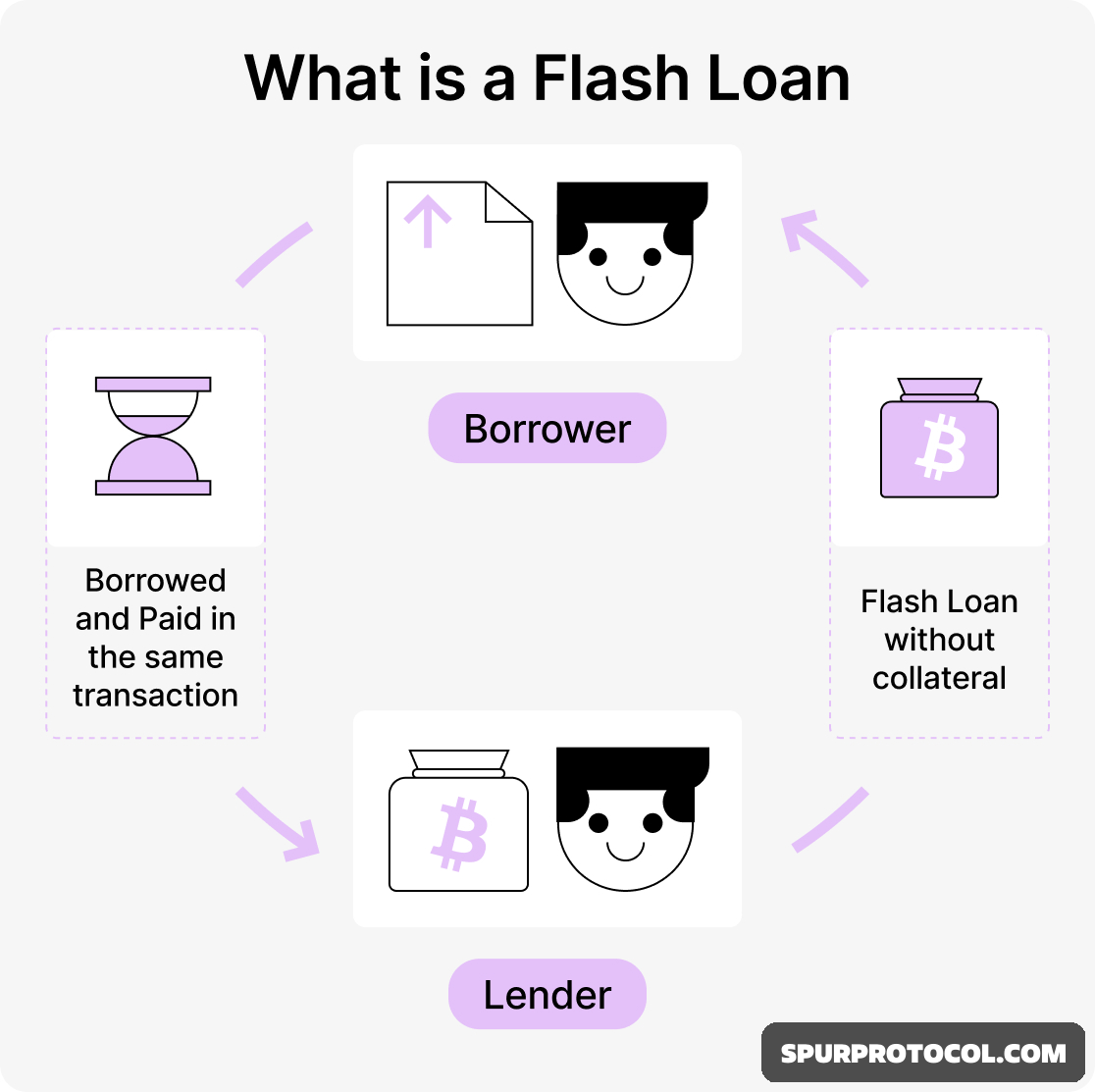

A flash loan is a unique type of uncollateralized loan offered by some DeFi platforms that allows users to borrow funds instantly and without collateral, as long as the loan is repaid within the same transaction block.

Here is How It Works:

1. Borrow a large amount of crypto instantly.

2. Use the funds for an operation (e.g. arbitrage, collateral swap, liquidation).

3. Repay the full loan amount (plus fees) within the same blockchain transaction.

But If the loan isn’t repaid within the same block this result in:

1. The entire transaction fails.

2. No funds are transferred.

3. It’s as if the loan never happened.

Some Common Use Cases include:

1. Arbitrage: Exploit price differences across exchanges.

2. Collateral swaps: Replace one type of collateral with another.

3. Self liquidation: Avoid liquidation fees by paying your own debt.

Some Risks around it:

While the borrower faces little risk (since there's no upfront collateral), flash loans are complex and have been used in exploits or hacks, especially when protocols have vulnerabilities.

Key Features:

1. No collateral required.

2. Zero risk for lender (thanks to atomicity of blockchain transactions).

3. Advanced and technical mainly used by experienced DeFi developers.

I hope you learn something new

Good luck 🫶.