What Is A Bonding Curve In Crypto?

By linking supply and demand, bonding curves provide a mathematical framework to the crypto industry and can be used to automate pricing and liquidity.

Go Back

🕒 7:29 PM

📅 Apr 17, 2025

✍️ By Ecojames

What Are Bonding Curves?

Bonding curves are mathematical models that aim to create a direct correlation between the supply of crypto assets and their price.

How bonding curves work in crypto

-In crypto, bonding curves set token prices in blockchain systems based on supply. As more tokens enter circulation, the price rises.

- When tokens are removed from the market, for example, through burning, where they are permanently destroyed, or a project repurchases them, the price drops.

-One example is a decentralized platform where users buy non-fungible tokens (NFTs) linked to an artist’s work. As demand grows, the token price increases, rewarding early supporters.

How the Bonding Curves Formula Works

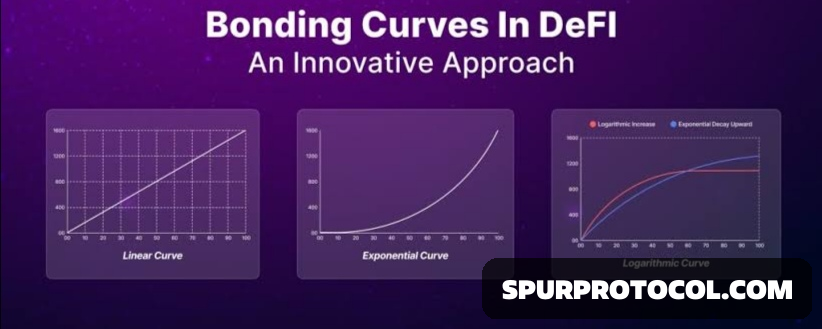

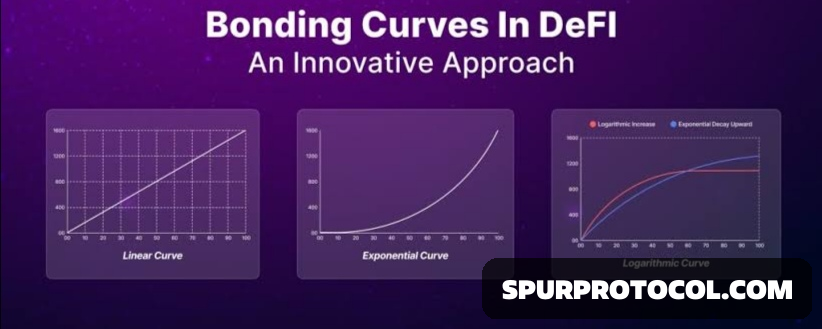

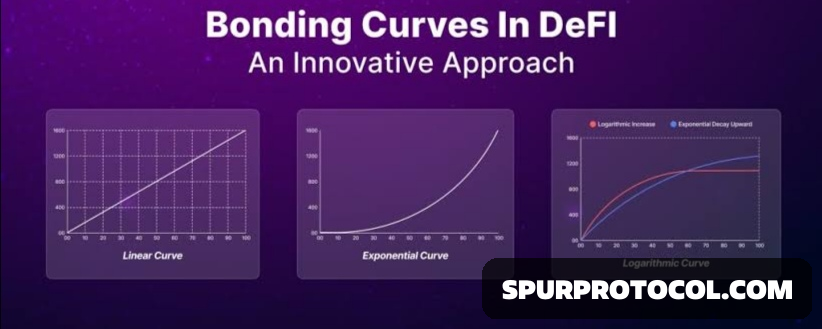

Bonding curves use mathematical models to determine token prices based on supply. The most common models include:

1.Linear curves

The price increases at a constant rate as more tokens are issued. This model keeps pricing predictable and works well for stable systems.

2.Exponential curves

The price rises faster as supply grows. Early tokens cost less, while later ones become more expensive. This model rewards early adopters and discourages late speculation.

3.Logarithmic curves

The price jumps early but slows as more tokens enter circulation. This structure helps projects attract early buyers while keeping long-term prices stable.

4.Custom curves

Some projects create unique pricing models based on token utility. A platform may offer early discounts, introduce price caps, or adjust pricing based on demand, governance decisions, or other external factors.

In blockchain systems, smart contracts automate bonding curves.

Limitations of Bonding Curves

1.Smart contract security and scalability can create challenges, while front-running, price manipulation, and volatility remain concerns in certain situations.

2. Smart contract vulnerabilities

Bugs or exploits in the contract’s code can interfere with bonding curve functions, leading to incorrect pricing, drained liquidity pools, or loss of funds.

3.Scalability concerns

Bonding curves must efficiently handle high transaction volumes. If the system is not optimized, delays and high gas fees can impact trading and limit adoption.

4.Front-running

Traders can exploit bonding curves by placing transactions before others to benefit from predictable price changes.

5.Price manipulation

Bad actors can artificially inflate or deflate token prices by rapidly buying and selling large quantities. This can mislead investors and create misleading market trends.

6.Unpredictable volatility

Small trades can cause sudden price swings in low-liquidity markets. This instability can make it harder for projects to maintain a stable token economy.