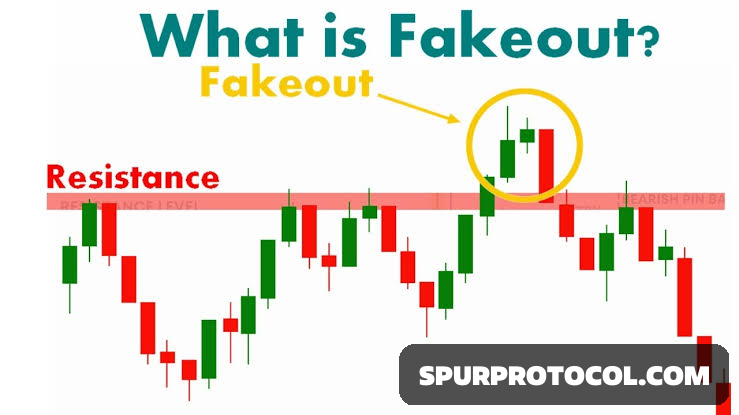

What Is A Fakeout?

This is a situation where a trader enters a position betting on a price movement that quickly reverses or ultimately doesn't happen.

Go Back

🕒 5:56 PM

📅 May 11, 2025

✍️ By Ecojames

A fakeout can cause considerable losses for a technical analyst. These investors will typically rely on well tested patterns, multiple affirmations of an indicator and specific allowances to protect from significant losses. Sometimes the setup can look perfect, but outside factors can cause a signal to not develop as planned.

Characteristics of a Fake Out

1. Break of Key Levels

The price breaks through established support or resistance levels.

2. Increased Volume

Often, fake outs occur with higher trading volume, which can mislead traders into thinking the breakout is genuine.

3. Quick Reversal

After the initial move, the price quickly reverses, often returning to the previous range.

4. Market Sentiment

Fake outs can be influenced by broader market sentiment, news, or economic events that momentarily sway prices.

Why Fake Outs Occur

1. Stop-Loss Triggers

Traders may place stop-loss orders around key levels. When these levels are breached, stop-loss orders can trigger, leading to further price movement in the opposite direction.

2. Market Manipulation

In some cases, larger players may intentionally create fake outs to trigger stop-loss orders and accumulate positions at better prices.

3. Psychological Factors

Traders' emotions and psychological biases can lead them to react to price movements in ways that create fake outs.

How to Identify and Trade Fake Outs

1. Confirmation Signals

Look for additional confirmation (e.g., candlestick patterns, indicators) before entering a trade after a breakout.

2. Volume Analysis

Analyze trading volume; a lack of sustained high volume after a breakout can indicate a potential fake out.

3. Time Frame Consideration

Watch for fake outs on shorter time frames, as they may not hold up on longer time frames.

4. Risk Management

Use stop-loss orders strategically to protect against unexpected reversals.