What Is A Golden Cross?

This is a bullish chart pattern where a shorter term moving average crosses above a longer - term moving average

Go Back

🕒 2:26 PM

📅 May 12, 2025

✍️ By Ecojames

What is a Golden Cross?

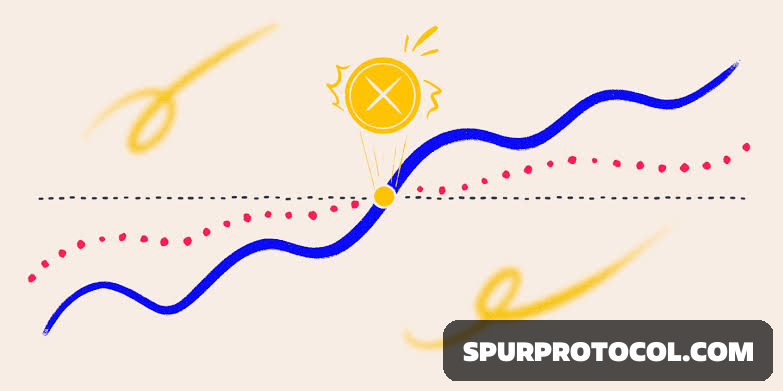

- Golden Cross is a term used to describe a bullish signal. It happens when a short-term moving average (50-day MA) crosses above a long-term moving average (200-day MA), signalling a potential upward trend in the market.

- Traders often view the Golden Cross as a good time to buy an asset, as it suggests that the price will likely continue to rise.

Three stages to a golden cross:

1. A downtrend that eventually ends as selling is depleted

2. A second stage where the shorter moving average crosses up through the longer moving average

3. Finally, the continuing uptrend, hopefully leading to higher prices

How to Use the Golden Cross

1. Traders can utilize the Golden Cross to help determine good times to both enter and exit the market.

2. The indicator can also be a tool that traders can use to help them better understand when it makes sense to sell and when it’s better for them to buy and hold.

3. Traders who sell short the market may use the golden cross as a signal that the bear market is over and it’s time to exit their positions.

4. The Golden Cross is applied to trading both individual securities and market indexes such as the Dow Jones Industrial Average (DJIA).

5. Some traders opt to use different moving averages to indicate a Golden Cross. For example, a trader might substitute the 100-day moving average in place of the 200-day. The pattern can also be looked for on shorter time frames, such as an hourly chart.

6. Many analysts also use complementary technical indicators to confirm the indication from a Golden Cross. Momentum indicators such as the Average Directional Index (ADX) or the Relative Strength Index (RSI) are popular choices. This is because momentum indicators are often leading, rather than lagging, indicators. Therefore, they can help in overcoming the Cross pattern’s tendency to significantly lag behind price action.

Limitations and Considerations

1. While the Golden Cross is a popular indicator, it is not infallible. Like any trading signal, it has its limitations and should not be used in isolation. Market conditions can change rapidly, and false signals can occur, particularly in volatile markets like cryptocurrency.

2. Traders should be aware of the potential for whipsaws, where the market moves in the opposite direction shortly after the crossover.

By recognizing these limitations it helps in maintaining a balanced trading approach.

- The Golden Cross can produce false signals in choppy markets.

- It may lag, as it relies on historical price data.

- Traders should be cautious during periods of high volatility.

- Combining signals from multiple indicators can help mitigate risks.

- Continuous market education is vital for adapting to changing conditions.