What Is Black Swan Event?

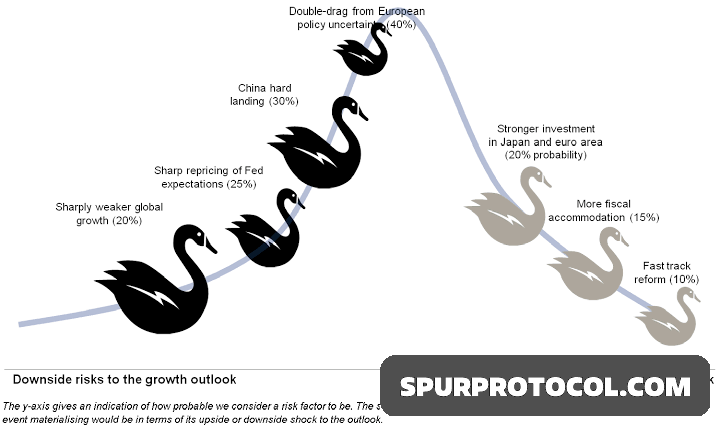

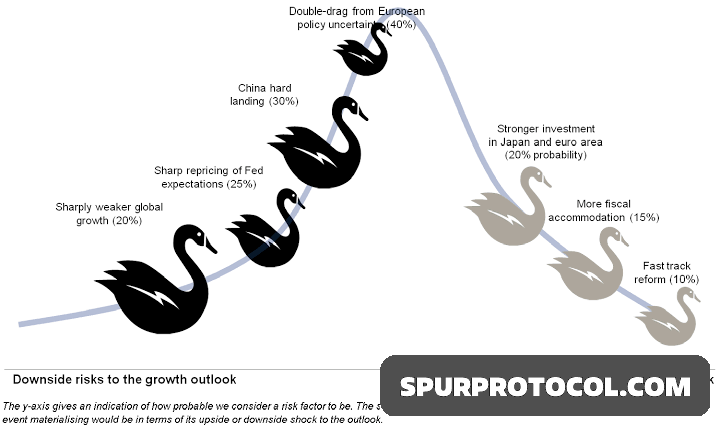

A Black Swan refers to an extremely rare and unpredictable event. These events typically have a massive impact and once they occur, can lead to catastrophic consequences.

Go Back

🕒 6:54 PM

📅 May 06, 2025

✍️ By Ecojames

-Black swan used by manipulators is a complex theory that one can't be certain when it occurs. Manipulators always have a hidden agenda toward the victims by using different means of communication that will hardly be understood by the victims. It is a form of communication that are designed to steal or get what they want from you without letting you realizing it instantly.

The 3 main characteristics of Black Swan events are:

1.Extremely difficult to predict

Their occurrence falls far outside the normal range of expectations.

2. Severe consequences

They have a profound impact on the economy and financial systems.

3. Hindsight explanation

While hard to predict beforehand, after they happen, clear explanations and potential preventive measures often emerge

Examples of Black Swans

1. Geopolitical Escalation

Heightened tensions or conflicts in regions like the South China Sea, Russia/Ukraine, or the Middle East could disrupt global trade and financial markets, leading to unpredictable impacts on CRE demand and investment flows.

2. Cybersecurity Crisis

A significant cyberattack on critical infrastructure—such as the electrical grid or financial systems—could paralyze CRE operations and undermine investor confidence in urban markets. Properties with stronger redundancy systems may see increased demand.

3. Tariff Wars

Intensifying trade conflicts could disrupt global supply chains, driving up construction costs and delaying CRE projects. This might shift tenant demand toward industries with a domestic focus over international trade reliance.

4. Social Media’s Role

The ability of social media to amplify public sentiment could lead to widespread counter-establishment movements, destabilizing certain markets. While this could discourage CRE investment in volatile regions, more stable markets may benefit.

5. Sudden Bank Failures

Unexpected collapses of major financial institutions could severely disrupt credit markets, limiting access to financing and stalling CRE transactions.

6. Crypto Surge

A spike in cryptocurrency values could challenge traditional banking systems and currencies, disrupting and/or innovating CRE financing.

7. Catastrophic Events

Natural or human-made disasters of global scale could lead to massive population shifts, reshaping urban demand and redefining the desirability of certain CRE markets.

8. AI Moves to Warp Speed

Rapid advancements in AI could displace jobs and reduce the need for traditional office spaces, while simultaneously boosting demand for high-tech industrial and data storage facilities.

9. Government Efficiency Initiatives (DOGE)

Efforts to streamline government operations may reduce the need for traditional office space, accelerating the transition to remote work. This trend could weaken demand for CBD offices but increase suburban and residential property values.

10. Energy Market Shock

A sharp rise in oil or energy prices could increase operating costs for CRE properties and cause expansion in energy-intensive sectors and markets.