What Is Fractional Reserve?

Fractional reserve is a banking system that allows commercial banks to profit by loading part of their customers deposits, while just a small fraction of these deposits are stored as real cash and available for withdrawal.

Go Back

🕒 6:33 PM

📅 Jun 13, 2025

✍️ By Ecojames

What is Fractional Reserve

- Fractional reserve banking is a banking system in which only a fraction of bank deposits are backed by actual cash on hand and are available for withdrawal.

- This is done to expand the economy by freeing up capital that can be loaned out to other parties

The Creation of Fractional Reserve Banking Systems

- The fractional reserve banking system was created around 1668 when the Swedish (Sveriges) Riksbank was established as the first central bank in the world

but other primitive forms of fractional reserve banking had already been in use.

The idea that money deposits could grow and expand, stimulating the economy through loans, quickly became a popular one. It made sense to use the available resources to encourage spending, rather than hoard them in a vault.

After Sweden took steps to make the practice more official, the fractional reserve structure took hold and spread fast. Two central banks were established in the U.S., first in 1791 and next in 1816, but neither lasted. In 1913, the Federal Reserve Act created the U.S. Federal Reserve Bank, which is now the U.S. central bank. The named objectives of this financial institution are to stabilize, maximize and oversee the economy in regards to pricing, employment, and interest rates.

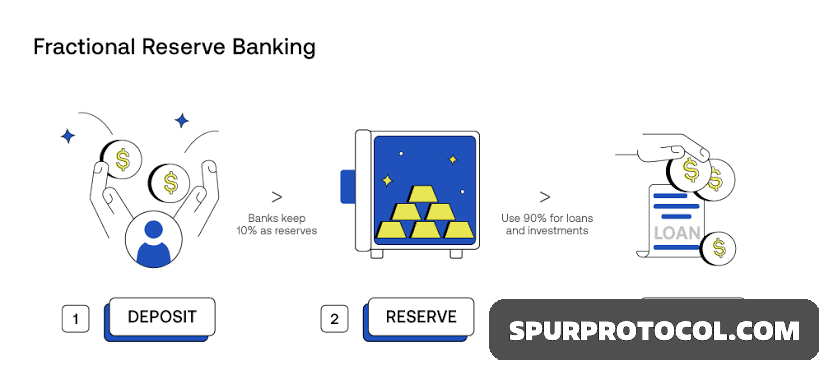

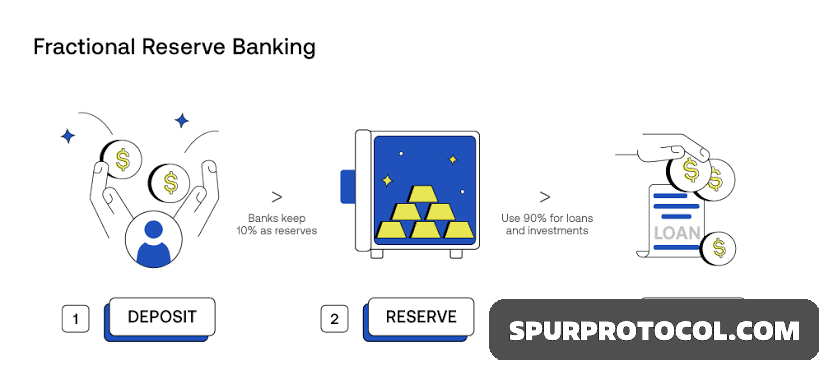

Fractional Reserve Banking Process

The fractional reserve banking process creates money that is inserted into the economy. When you deposit that $2,000, your bank might lend 90% of it to other customers, along with 90% from five other customers' accounts. This creates enough capital to finance $9,000 in loans.

Your balance still reflects $2,000, and the customers that the bank borrowed from also see their balances remain unchanged. If all five customers have account balances of $2,000, it will look something like this:

- You and four other customers have $2,000 each, deposited in savings accounts that pay 1% per year.

- If the bank can use 90% of its deposits for loans, the available capital is $9,000 (90% of $10,000).

- A sixth customer asks for a loan of $1,000.

- The bank borrows 10% from each of the five accounts, totaling $1,000.

- There is still a balance of $2,000 in each account ($10,000 total between the five accounts).

- The bank essentially created $1,000 and lent it to the borrower at 5% per year.

- You receive interest payments of 1% per year on your $2,000, and the bank pockets the difference of 4% as profit.