What Is Margin In Trading?

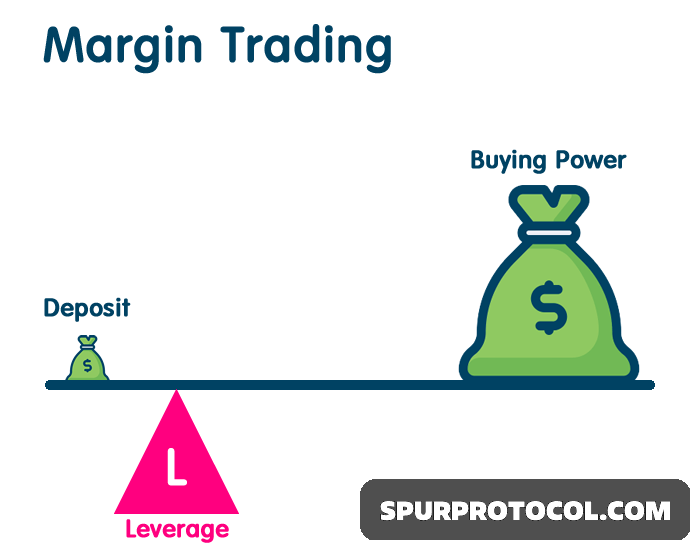

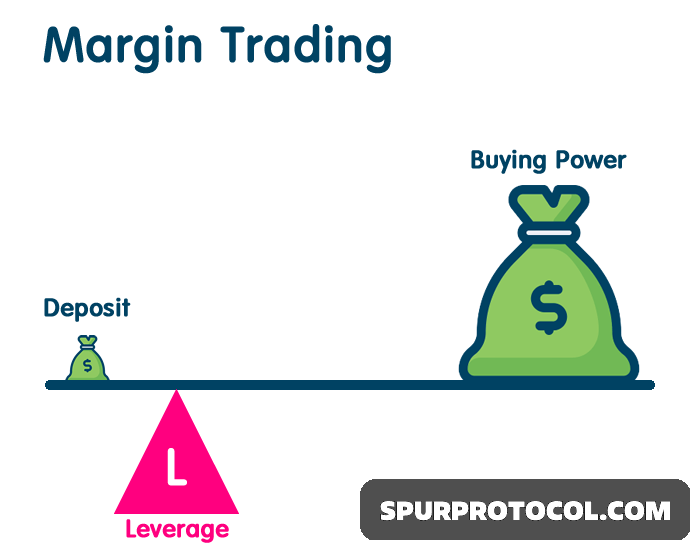

There is an inverse, proportional relationship between the margin required and the leverage provided. For example, higher leverage means you need a smaller margin to control a larger position size.

Go Back

🕒 7:33 PM

📅 Oct 04, 2025

✍️ By chrison2

Margin is the amount of money required to open and maintain a trade. Think of it as a loan from the broker, allowing traders to open larger positions than their account balance would normally allow. Margin acts as collateral and is typically expressed as a percentage of the total position value.

There are 2 types of margin. Used margin is the amount of capital that is currently being used as security to sustain open positions. Free margin is the remaining amount of capital available to open new positions. For example, if your total account balance is 5,000 USD and used margin is 3,800 USD, you will have 1,200 USD free margin to open new positions.

How to calculate margin?

Traders can use Deriv’s forex margin calculator which is based on the formula:

Margin = (Volume x Contract size x Asset price) / Leverage

For example, let’s say you want to trade 3 lots of EUR/USD with an asset price of 1.10 USD and a leverage of 30. You will require a margin rate of 11,000 USD to open the position.

(3 x 100,000 x 1.10) / 30 = $11,000