What Is The Efficient Market Hypothesis?

(EMH) is an economic theory stating financial markets reflect all available information on the price of assets at any time.

Go Back

🕒 9:00 AM

📅 May 11, 2025

✍️ By Ecojames

The efficient market hypothesis (EMH), alternatively known as the efficient market theory, is a hypothesis that states that share prices reflect all available information and consistent alpha generation is impossible.

Assumptions of the Efficient Market Hypothesis

Also referred to as an efficient market theory, EMH is based on the following assumptions :

1. Stocks are traded on exchanges at their fair market values.

2. This theory assumes that the market value of stocks represent all relevant information.

3. It also assumes that investors are not capable of outperformig the market since they have to make decisions based on the same available information

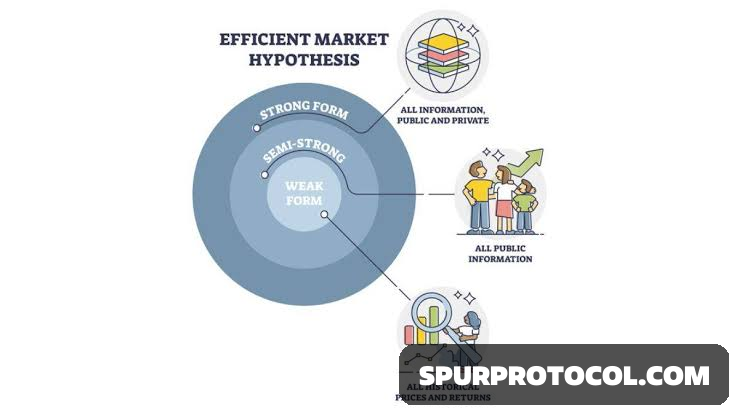

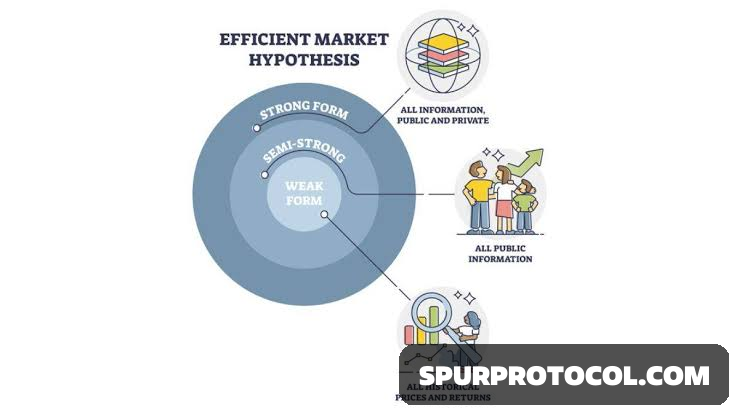

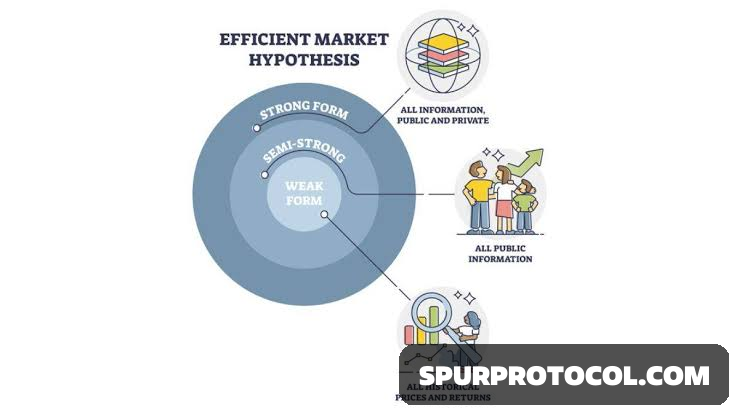

Variations of the Efficient Markets Hypothesis

There are three variations of the hypothesis – the weak, semi-strong, and strong forms – which represent three different assumed levels of market efficiency.

1. Weak Form

The weak form of the EMH assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available.

2. Semi-strong Form

The semi-strong form of the theory dismisses the usefulness of both technical and fundamental analysis. The semi-strong form of the EMH incorporates the weak form assumptions and expands on this by assuming that prices adjust quickly to any new public information that becomes available, therefore rendering fundamental analysis incapable of having any predictive power about future price movements.

3. Strong Form

The strong form of the EMH holds that prices always reflect the entirety of both public and private information. This includes all publicly available information, both historical and new, or current, as well as insider information. Even information not publicly available to investors, such as private information known only to a company’s CEO, is assumed to be always already factored into the company’s current stock price.

Limitations of the Efficient Market Hypothesis

1. Market crashes and speculative bubbles

Speculative bubbles tend to arise when the price of a financial instrument rises above its fair market value and reaches a point where market corrections take place. During this situation, prices begin to fall rapidly, which leads to a market crash.But EMA suggests that both financial crashes and market bubbles should not arise. As a matter of fact, this theory completely dismisses their existence.

2. Market anomalies

Market anomalies refer to a situation where there is a difference between the trajectory of a market price as established by the efficient market hypothesis and its behaviour in reality. Market anomalies may arise anytime for no particular reason. This proves that financial markets do not remain efficient at all times.

3. Behavioral economics

Behavioural economics dismisses the idea that all market participants are rational individuals. It also suggests that difficult circumstances may put stress on individuals, forcing them to make irrational decisions.